More than a billion people globally will celebrate the Year of the Rat. Should you be embracing China, from an investment perspective that is? Or should you be avoiding it for a raft of reasons, the latest being coronavirus?

More than a billion people globally will celebrate the Year of the Rat. Should you be embracing China, from an investment perspective that is? Or should you be avoiding it for a raft of reasons, the latest being coronavirus?

It was a strong year for the Chinese stock market, reflected by the average China fund being up in excess of 22% in 2019. Despite the best efforts of Trump, China equities have been impressively resilient in 2019. Whether Trump-inspired or otherwise, heightened geo-political conflict looks like being the “new normal”, and investors are more relaxed about such tensions.

Where has China been?

In the 12 years since the last Year of the Rat, China doubled its GDP and delivered an average annual growth rate of 7%.

Last week we reviewed The Asian Century so far, and China equities are up 210%, versus 167% for the US, which tends to hog the publicity.

For our part, despite some extreme volatility along the way, we have been mostly positive, and continue to be. Why?

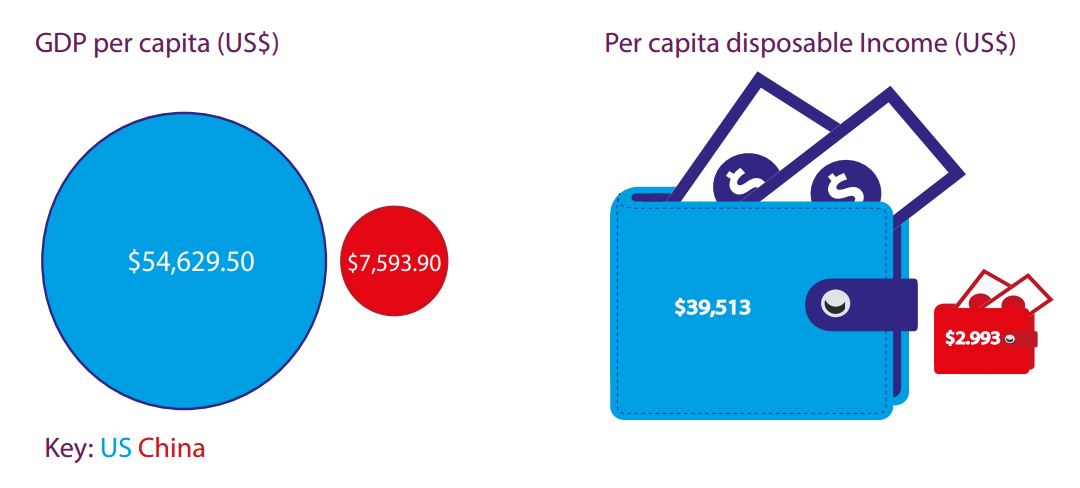

Here is one chart we produced in February last year in our “Pig Out On China?” blog. The catch-up potential could not be clearer.

How about this table from the October 2018 blog, “China – cheap – focussed – determined – BUY”, showing the countries with the greatest number of tech, engineering and maths graduates:

- China: 4.7m

- India: 2.6m

- US: 568,000

- Russia: 561,000

- Japan: 195,000

Source: World Economic Forum

|

These levels of education and expertise will drive China’s advance for decades to come.

…And where is China going?

President Xi Jinping is successfully executing a strategy that aims to make China the world’s largest economy by 2049 – the 100-year anniversary of the Communist Party taking power.

And that worries many in the US, as we explored in “Miss Liberty, Made In China”. Global domination by the US is under threat, and they get that in the US. The battleground will not be trade, but technology, as we explored in “Trump-China heavyweight cyber rumble”.

Ironically, US action (on Huawei and otherwise) has served to escalate the Chinese drive to tech self-sufficiency – another US own goal. The technology sector continues to enjoy strong policy support in China, and benefits from a huge domestic market.

Shorter term risks?

Debt is often cited as THE reason not to buy China, and we covered this in those earlier blogs, such as “China – cheap – focussed – determined – BUY”, for example:

- China’s total debt to GDP ratio is a lot less than Japan, and about the same as the US and EU

- Much of this debt is derived from state-owned enterprises or local government

- Deleveraging is taking place, albeit slowly…

- …and this is a top policy priority

- Consumer debt is not particularly high (e.g. lower than UK)

Interestingly, the People's Bank of China appears committed to allowing defaults to rise and weak banks to close – in sharp contrast to Western central banks. This kind of approach will certainly support the country’s long-term economic growth and structural reforms – ironically, a capitalist approach, clear the dead wood as you go, create space for growth.

The wall to wall media coverage of the coronavirus should not lead you to believe it must be a huge problem – last year Brexit, last week Meghan and Harry, this week coronavirus, next week… who knows.

It does not appear as serious as prior episodes, such as SARS back in 2003 – hopefully it will stay like that. What we can observe with greater clarity is a much more effective response from the Chinese authorities – much has been learned since 2003.

Market attractions

Taking into account the longer term attractions highlighted in those earlier stats, plus reasonable valuations and earnings growth expectations for 2020-21, we remain optimistic about the outlook.

The more interesting opportunities might be in medium sized and smaller companies, as a number of “foreign favourites” have already re-rated significantly. Smaller companies are less well researched and therefore often overlooked, in China just as elsewhere in the world.

Plus investing in these smaller businesses means getting exposure to opportunities in niche industries with huge potential, especially within IT and healthcare.

It has never really been a question of whether investors, but rather how and how much they should own. That is what we will explore next week along with fund suggestions for both investment trusts and unit trusts.

FURTHER READING