The headlines have been disturbing for weeks. It feels like markets, particularly the US, have collapsed. But they haven’t. The S&P 500 is only down 10% from its February peak, and the tech centric NASDAQ Composite is off 15% from its December high.

The headlines have been disturbing for weeks. It feels like markets, particularly the US, have collapsed. But they haven’t. The S&P 500 is only down 10% from its February peak, and the tech centric NASDAQ Composite is off 15% from its December high.

There are some ugly individual falls from recent peaks (Tesla off by 50%, Palantir by 35%), but across the US markets a whole, there is no sign of panic. This lack of panic might be good or bad news…

The possible good news is that this is a run-of-the-mill correction. Though do note that short term support for the S&P 500 is 7% or so on the downside, in the range of 5000-5200, so if merely a correction it appears to have more downside.

The alternative, the bad news, is that this is the early stages of the bursting of the extraordinary US bubble, with ultimate falls of 50-70%.

We will only know definitively with the benefit of hindsight, which is not helpful. So you are going to have to think carefully now about your asset allocation, how you are selecting funds/stocks, cash levels, and your stop-loss strategy (including when and how to buy-back).

Though the indicators of panic are nowhere near flashing, one senior bod from TD Securities, “a leader in capital markets and banking”, is quoted as saying:

“The market’s gone from exuberance about growth to absolute despair”.

Yet the falls to date are definitely not reflecting that despair. One investor put it a different way: “why do I feel like I have just been robbed at gun point? My losses are only in single figures.”

The breadth and depth of investor complacency is profound, and has built up over quite a few years. In recent weeks the pillars of that complacency are being aggressively tossed aside, and that is mentally unsettling for those who until recently were comfortably nestling in the midst of a cheery consensus.

Clearly the mental state of the herd is a bit frazzled and the discomfort is clear, but, as yet, the herd is nervously hanging together. The “torschlusspanik”, literally door-shut-panic, lies ahead.

There is nearly always a gap between a big real world event and an appropriately large market reaction. A great example was Lehman Bros going bust in September 2008. It took 10 days for the S&P to respond to an event which couldn’t have been scarily clearer. Like Wile E Coyote running out over the cliff – for 10 days the herd of overconfident investors did not want to look down and have to acknowledge reality. Right now it feels like markets have not yet caught up with unfolding events.

Yet I also acknowledge that there is possibly sufficient complacency and denial to turn the US round and up to new highs. Bloomberg reported on this denial on 13th March, denial being a textbook feature in the weeks and months after a significant peak:

“retail investors poured 47.3 billion into equities in the week… Leveraged ETFS saw more than $1 billion of inflows… ARK Innovation saw nearly 4300 million of buying on Monday as a levered version of the portfolio saw its biggest week of inflows since 2022.”

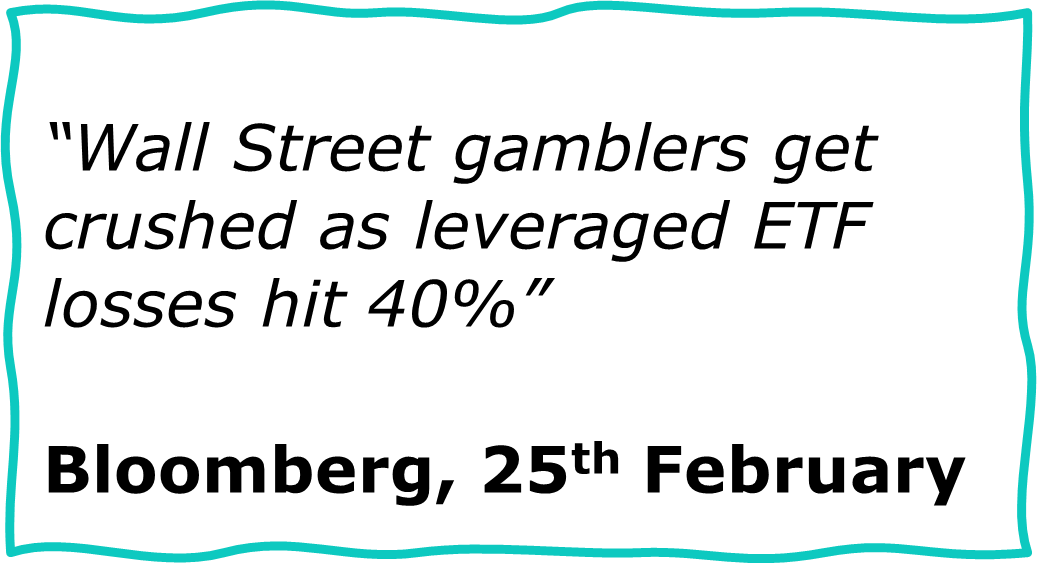

When we get to the panic stage of the downturn, whether that be after another new high or just ahead, it will likely be wipeouts in leveraged ETFs which catch the headlines. If panic gathers pace heading into a weekend, and the media has a nervous breakdown on the weekend, it will be another Black Monday to add to the history of financial markets.

Before Christmas the investment bank consensus was no US recession in 2025, “US Exceptionalism”, and that you needn’t bother investing anywhere else in the world. This was tosh, as we said on 13th December. Similarly on 10th January, “consensus views have a tendency to unravel when reality bites”. When all the forecasters agree, something else is likely to happen, as Bob Farrell said.

On to more positive matters, we’ve not had cause to mention silver in many years, but this month it has sent an interesting signal. Silver is the volatile younger brother of gold. From prior decades, my sense was that a gold bull market had never really caught the imagination of investors until silver started moving up sharply too. While it is only a short period to review, since 28th February, gold in USD is up 4.65%, and silver up 9.25%, a considerable difference

The numbers are even bigger with miners, gold miners up 8.8% and their silver peers 15.1%.

Silver has turned a significant corner, and there appears to be some way to go for both gold and silver, the metal and the miners.

For example, the positive gold headlines have certainly proliferated since the New Year, but there are no signs of manic buying, nor the parabolic spike higher which typically lights up the final crazy phase of a commodity bull market.

Jupiter Gold And Silver has been increasing its exposure to silver miners. iShares Physical Silver (SSLN) is another option.

A similar performance gap has opened up between two Chinese ETFs. iShares China Large Cap has grown by a handsome 15.8% year to date. But the Hang Seng Tech ETF (HSTC) is even better, up 27%. The latter will be more volatile, but the intra-day dealing does give some comfort.

Last but not least, every day this week the FTSE Small Cap ex ITs index has evidenced some buying early in the day. This kind of tickling away is positive. Ideally it will gather momentum. Fingers crossed… which is only an acceptable investment strategy if you have a stop-loss and are ready to apply it without hesitation!