In our monthly Dynamic Portfolio review we provide some background commentary and insights, as well as performance tables & graphs, risk tables, and where to go to find the new funds for each Dynamic Portfolio.

As ever, if you have any questions about the below research please do not hesitate to contact us.

The new funds for each Dynamic Portfolio will be listed below, or alternatively you can view the new funds on the designated Portfolio Library page.

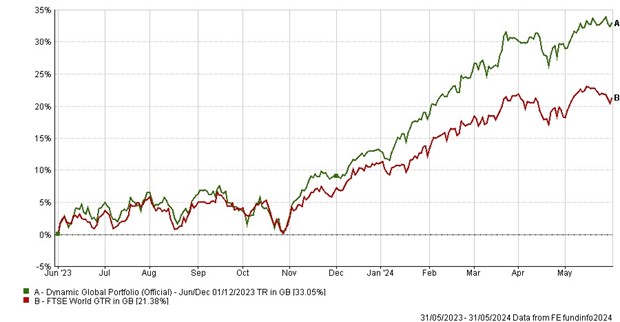

Performance Graphs will be over one-year period unless stated otherwise.

The Dynamic Portfolio’s below are sorted A-Z.

Commentary

It has been an excellent 6 months for the Dynamic Global Portfolio, up just shy of 22% whilst the FTSE World Index is up around 14%.

Since inception this portfolio is up 1,178%, which is 2.4x the index. This isn’t a “star” portfolio for us, but that much outperformance remains impressive.

This is an interesting portfolio because it provides automatic global diversification, as you will see on the Portfolio Library page.

All three funds change this month with Japan out and the US dominating. One large and one small cap US growth fund make it in for the next 6 months. It’s good to see the UK continue to perform well as a new UK fund makes up the final space.

Performance data as of 31/05/2024

- Dynamic Global Portfolio

-

6-Month Performance

Dynamic Global Portfolio: up 21.97%

FTSE World Index: up 13.94%

Annual Performance Chart Performance Table

Performance Table

|

Name

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Dec 99)

|

|

Dynamic Global Portfolio – Jun/Dec

|

21.97

|

33.05

|

9.36

|

63.80

|

1178.12

|

|

FTSE World Index

|

13.94

|

21.38

|

35.22

|

81.77

|

489.99

|

Risk Table

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Dynamic Global Portfolio - Jun/Dec

|

-14.20

|

15.60

|

-6.63

|

|

FTSE World Index

|

-12.52

|

13.31

|

-5.29

|

Review Table

Performance data as of 31/05/2024

*A measure of the size and frequency of short-term changes in the value of an investment.

**Monthly Value at Risk (VaR). A VaR of 6% means that in 19 months out of 20 you should not, on average, expect a fall in the capital value of more than 6% in any one month. The VaR of a typical UK stock market fund is 6%, for reference.