If you twist my arm there are some considerable positives as I peer into 2025, and I will come to those in a moment but first…

It’s the event you never see coming which changes your life, and in the last year or so there have been many “no one saw that coming“ events. The latest saw Bashar al-Assad scuttling off to Moscow. Not long before was the blow-up in South Korean politics, and elections around the world are becoming increasingly unpredictable.

in the last year or so there have been many “no one saw that coming“ events. The latest saw Bashar al-Assad scuttling off to Moscow. Not long before was the blow-up in South Korean politics, and elections around the world are becoming increasingly unpredictable.

In stark contrast, financial market bubbles and manias are perfectly predictable as they derive from the most basic human instincts of greed and herding. In financial markets the “no one saw this coming” event will be “the final snowflake” (see 15th November note). Unknowable it might be, yet the search for this snowflake gathers huge momentum at this time of year, and I have returned to my inbox overflowing with not always humble 2025 predictions.

Mostly they talk of “US exceptionalism”, such that investors should own the US to the exclusion of all other possibilities. A smaller number accept the considerable downside risk (50% or so), but believe that this is some way off and you can still make money concentrating on the US.

We covered the issue of US exceptionalism here. It is a myth. This is how we summarised the research on the point:

“In a nutshell, during economic expansions and bull markets for equities, the US stock market does sharply better. This appears to arise because larger sums are borrowed and bet on that expansion, particularly when there is some new technology to excite entrepreneurs and investors alike. Not only is it easier to borrow money in US upturns, but they are culturally more inclined to take on risk, and manic and over-confident investors inflate the stock market to bubble levels.”

That is a pretty good description of where we are today, as well as prior US bubbles. Then it all goes to pot:

“When recession hits, and dashes the hopes of the over-borrowed, there is a lot of downside. This is when the UK stock market closes the gap against the US. It appears that over whole cycles (the up and the down), there is not so much difference between the US and UK.”

This is good news for those who feel a tad uncomfortable jumping on the US bandwagon, and can see opportunities elsewhere. Let’s start with China.

Increasingly it appears that a more confident Chinese leadership will directly challenge the US. This week they got their retaliation in early on Trump’s mooted tariffs, launching an antitrust probe into the AI darling Nvidia, which generates 15% of sales in China. This followed the announcement the week before that China will ban sales of key “rare earths” to the US, essential for US production across a wide breadth of technologies, from chips to EV batteries. None of this is damning for the US, but it clearly illustrates that China will be more combative, which will give Trump pause for thought.

On Tuesday President Xi pledged to hit their 5% growth target, and the day before that the Politburo announced that they will loosen monetary policy and “strengthen extraordinary countercyclical adjustments”. This is code for we’re in a hole, we know we’re in a hole, and we will do whatever it takes – basically, it was a Draghi moment. They know there is a desperate need to boost domestic consumption next year. Now they must act, not just talk.

President Xi rejected an unprecedented invitation to the Trump inauguration in January. While the invitation was lauded by many in the US media, “it tips rivals off balance, gives us an advantage”, in China and beyond there is more of an inclination to see it as more evidence of an unstable leader of the world’s leading nation at a time of global instability not seen since the Cuban missile crisis in 1962 or the oil shock of 1973.

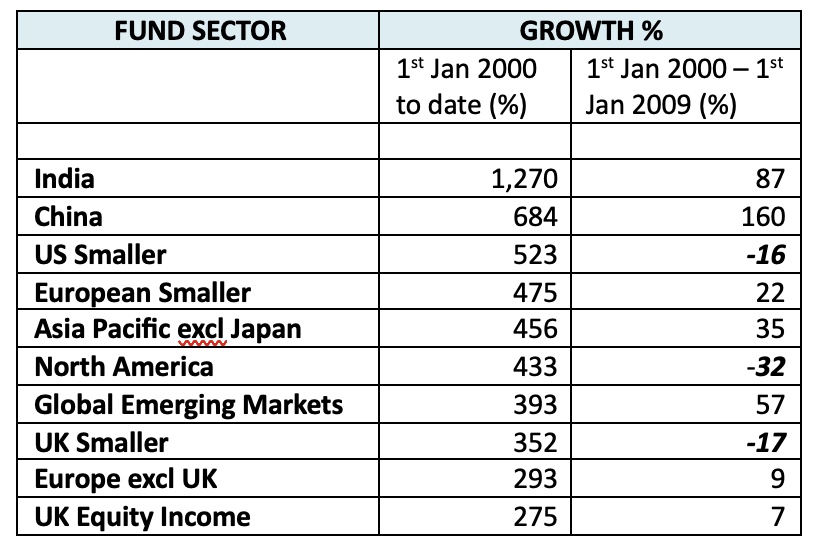

As we stumble towards the end of the 1st quarter of the 21st century, it is fascinating to see how various parts of the investment world have performed through the prism of their fund sectors, the most interesting being the relative performances of China and the US. It is set out in the table below, showing the average total return for each sector.

Since the turn of the millenium it is India which is the star, massively outperforming the rest of the world. Second is China, followed by US small caps, with mainstream US down in 6th place. US-obsessives might be surprised by this. They will be shocked by the performance in the first decade! This is shown in the second column. The two US fund sectors both lost money, along with UK smaller companies.

While some might have guessed that India was a star over the whole period, they were much less likely to have realised that China excelled over both periods since the millenium. We said it would be The Asian Century, it has been, and I believe more of the same should be expected.

Those who believe that the exceptional performance of the US in the last 10 years can be easily extrapolated over the next 10 or 25 years should be ever so ‘umble. Why? Because the evidence says so, as set out in Friday Notes past. For example, the latest forecast from GMO is for real returns from US equities of minus 5.4% over the next 7 years. Don’t shoot the messenger. This is based on a statistical analysis of US and global valuations and what typically happens in the years following valuations at prevailing levels. But you can instead dismiss their objectivity and “go with your gut”.

If you twisted my arm on what 2025 might look like for equity markets, I will humbly stick to the middle ground of expectations, while acknowledging that such prognostications are typically worthless…

Trump to cut taxes and boost US smaller companies. Trump to realise the attractions of working with China, who in turn will apply a massive stimulus to their domestic economy, a huge kicker for Chinese and Asian markets. The EU to work hard getting France and Germany out of a hole, with European Value and small cap funds the obvious beneficiaries. And if all of that comes to pass the UK stock market should attract buyers across a broad front, both the global brands in the FTSE 100, and the cheap Value-style stocks populating the FTSE 250 and small cap indices.

This mix of global stimulus should give a fillip to commodities (though not necessarily oil), and gold can continue its bull market as the US dollar begins to drift lower again. The latter should also assist emerging market bonds.

On negatives, if capital spending on AI falls away as big corporates enjoy only limited productivity gains, tech stocks will take a hit. In this situation Growth would notably underperform Value. On bonds, the mountains of government debt continue to be a major concern, but when this accident happens is anyone’s guess. Inflation will likely bounce around, and we can only hope there are no more inflation shocks (war or climate event?) as all bets will be off across the board.

It's a busy time for us now. The 45th edition of our acclaimed TopFunds Guide is being drafted, and a variety of seminars are planned for the first quarter of 2025. But first, one last Friday Note for 2024 next week, including one or two reading and listening recommendations.