Last week I considered the late Queen’s observation of market turmoil in 2008.

Why did nobody see this coming? This week I wanted to re-emphasise that where we are today is somewhat more serious than in 2008.

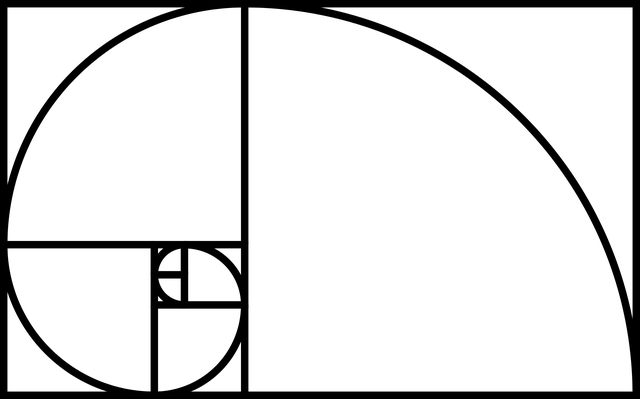

It all began in the early 1800s with mathematician Carl Freidrich Gauss, in Gottingen Germany. He found a way to show a jumble of statistics in an orderly and meaningful way – the bell curve – an example of which you can see here in this FREE copy of chapter 5 of my book Clueless.

Take the average height of an American male, which is 5’10’’. With the benefit of the bell curve, you can vividly see that 68% of the time men’s height falls 3 inches on either side, that is 5’7”- 6’1” (called “one standard deviation”). And 95% of all men are 5’4”-6’4” (which is “two standard deviations”).

Then there is the incidence of three standard deviations, which is what happens only 0.3% of the time, so rarely. But bearing in mind the size of the U.S. male population, you can still predict that 28 men will be between 7’1” and 7’4”.

This mix of different heights is what is called a “normal” distribution – and I emphasise “normal”. In simple terms, it means certain extremes are not just improbable but impossible – for example, you cannot grow to be a mile in height.

The questions Gauss was asking with his bell curve were similar to those to which we might like an answer e.g. “how likely is the stock market to fall by 20% next year?”.

But the problem is that investments are not “normal” in a way which can usefully be measured or represented by the bell curve. You can disregard the possibility of someone growing a mile high – it isn’t even a possibility. But you can’t disregard even a remote possibility in financial markets – in fact, you have to allow for possibilities which have never been seen before, the acutely abnormal.

Yet investment models have been built on this kind of maths and were (and are still) not just wrong, but dangerously wrong, as we saw in 2008.

The problem was, and remains, that extremes occur commonly in financial markets. And this was not allowed for in the bell curve, the Black-Scholes equation, or VaR employed widely across financial markets and by central banks and regulators.

This maths suggests these were improbable events, but they were actually occurring all the time! The maths disregarded the big market moves – but it was big market moves that would bring the banks (and the whole system) down in 2008.

Here we are in 2022, and 2008 seems like a blip in comparison. Vast sums were thrown at financial markets in 2008 and for many years. Politicians side-stepped difficult decisions, and left in charge unelected central bankers, with an unfortunate track record of being wrong on key decisions. All of this allowed a new complacency to take hold in financial markets.

The result is a unique investor mania and valuation bubble, even more mountainous debt, which is unaffordable at even modestly higher interest rates, and the development of a rare and nasty economic phenomenon (stagflation) which is already causing severe pain for ordinary people around the globe – and it is still early days.

It will not be an easy period for investing. But from the ashes will emerge some of the best opportunities of my lifetime – we all just need to be patient.

NB You can download here a FREE copy of chapter 5 of my book Clueless.