As ever, if you have any questions about the below research please do not hesitate to contact us.

The new funds for each Dynamic Portfolio will be listed below, or alternatively you can view the new funds on the designated Portfolio Library page.

Performance Graphs will be over their review period unless stated otherwise.

The Dynamic Portfolio’s below are sorted A-Z.

Commentary

Three Dynamic Portfolio updates for this month.

- Dynamic Japan Portfolio

- Dynamic UK Blended

- Dynamic World ex-UK

Dynamic Japan

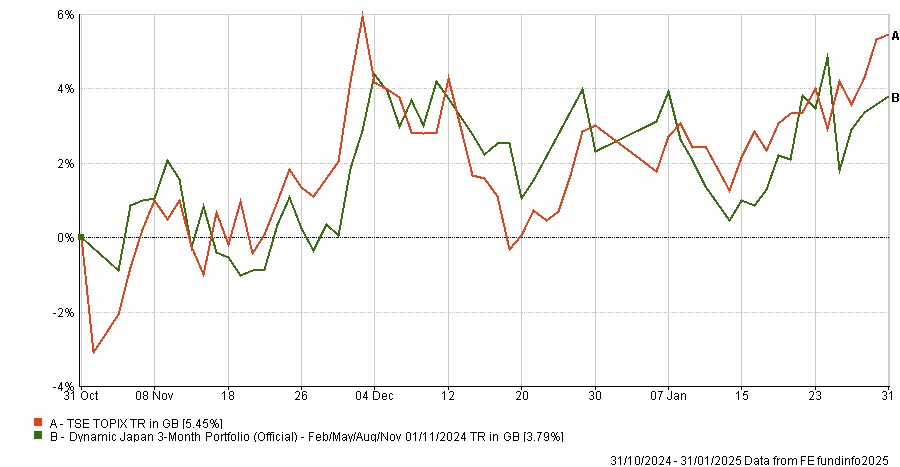

As a reminder, the review period for this portfolio is every three months, an exception to our norm. It was a decent return of 3.75%, although the Topix index closed stronger at 5.45%.

It remains an excellent Dynamic portfolio, focused on an area which is undervalued and which has outperformed the index by over 3.5x since inception in 2000.

The new fund is a large cap value fund for the next three months.

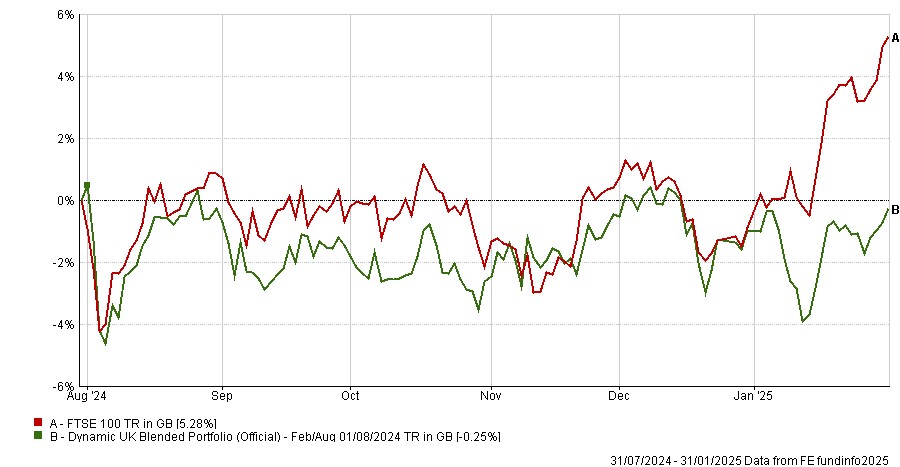

Dynamic UK Blended

A challenging six months for this Dynamic Portfolio, down 0.25% whilst the FTSE 100 was up 5.28%. This was mainly due to smaller caps struggling over the period vs their larger cap peers.

If the smaller cap index is a decent barometer of confidence in UK plc, it drifted over the past six months, worsened by the first Labour budget.

That said, the long-term performance of this portfolio is impressive, up over 1,000% since inception and over 4.5x the index.

The next three funds to go in are larger cap focussed to reflect their strong performance over the previous six months.

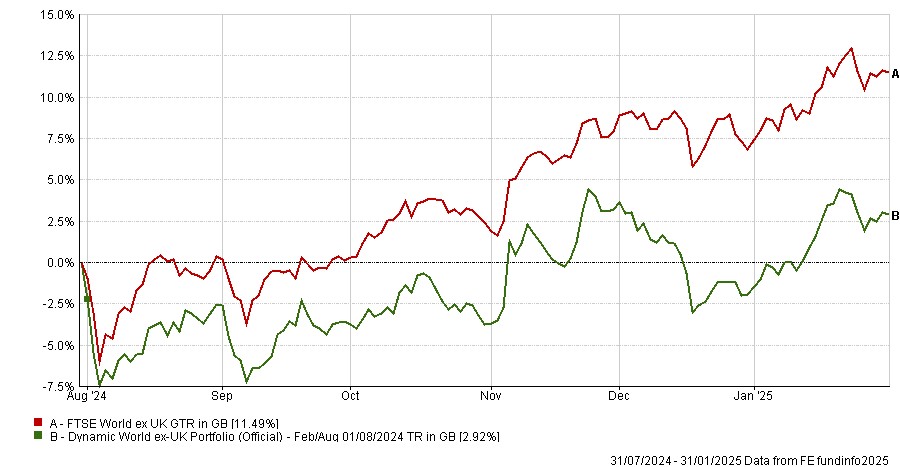

Dynamic World ex-UK

While this portfolio posted a gain for the period, it lagged its benchmark due to the underperformance of small-cap, particularly UK-focussed, funds in the mix.

The next period sees an interesting selection of US large cap, US small cap and China funds.

Over the long term, the portfolio remains strong, nearly double the index since inception.

This is an interesting portfolio, and we recommend checking out the way it is structured here.

- Dynamic Japan 3-Month Portfolio

-

3-Month Review

Dynamic Japan 3-Month Portfolio: up 3.79%

TSE TOPIX Index: up 5.45%

Review Period Performance Chart

Performance Table

|

Name

|

3m

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Feb 00)

|

|

Dynamic Japan 3-Month Portfolio

|

3.79

|

3.44

|

19.52

|

27.40

|

59.16

|

436.47

|

|

TSE TOPIX

|

5.45

|

0.11

|

6.67

|

24.56

|

34.61

|

121.83

|

Risk Table

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Dynamic Japan 3- Month Portfolio

|

-17.55

|

16.98

|

-8.33

|

|

TSE TOPIX

|

-13.27

|

12.15

|

-6.75

|

Review Table

- Dynamic UK Blended Portfolio

-

6-Month Performance

Dynamic UK Blended Portfolio: down 0.25%

FTSE 100: up 5.28%

Review Period Performance Chart

Performance Table

|

Name

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Feb 00)

|

|

Dynamic UK Blended Portfolio

|

-0.25

|

13.13

|

25.29

|

59.97

|

1004.35

|

|

FTSE 100

|

5.28

|

17.95

|

30.14

|

42.66

|

237.45

|

Risk Table

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Dynamic UK Blended Portfolio

|

-21.83

|

18.56

|

-5.58

|

|

FTSE 100

|

-13.41

|

13.59

|

-5.15

|

Review Table

- Dynamic World ex-UK Portfolio

-

6-Month Performance

Dynamic World ex-UK Portfolio: up 2.92%

FTSE World ex-UK Index: up 11.49%

Review Period Performance Chart

Performance Table

|

Name

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Feb 00)

|

|

Dynamic World ex-UK Portfolio

|

2.92

|

19.16

|

38.69

|

88.36

|

1157.42

|

|

FTSE World ex-UK Index

|

11.49

|

24.32

|

42.65

|

90.89

|

595.68

|

Risk Table

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Dynamic World ex-UK Portfolio

|

-14.81

|

14.06

|

-5.88

|

|

FTSE World ex-UK Index

|

-12.60

|

13.33

|

-5.21

|

Review Table

*A measure of the size and frequency of short-term changes in the value of an investment.

**Monthly Value at Risk (VaR). A VaR of 6% means that in 19 months out of 20 you should not, on average, expect a fall in the capital value of more than 6% in any one month. The VaR of a typical UK stock market fund is 6%, for reference.

Performance data as of 31/01/2025