Last week we asked “Worth a punt in gold or commodities?”. Perhaps we were unfair on commodities, as longer term analysis suggests it is more than a short term punt, in particular as commodity prices tend to move in quite large waves. For long term investors commodity funds look cheap.

Last week we asked “Worth a punt in gold or commodities?”. Perhaps we were unfair on commodities, as longer term analysis suggests it is more than a short term punt, in particular as commodity prices tend to move in quite large waves. For long term investors commodity funds look cheap.

(Worth a punt in gold or commodities?)

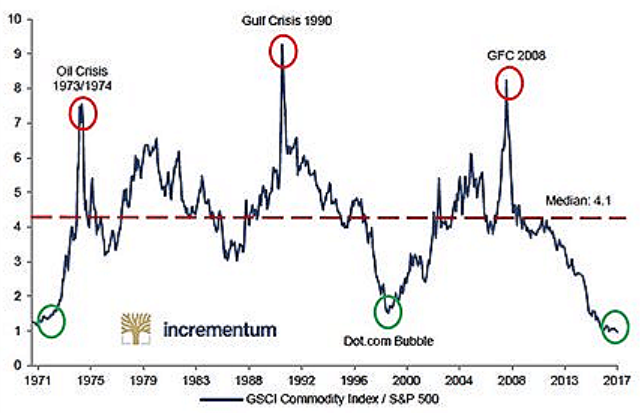

Commodity prices tend to move in quite large waves, partly because of the long delays from discovery to production, and partly because of over-supply just when the economy is rolling over. Which takes years to work off. This is captured in chart 1 below, provided by incrementum, which vividly highlights the large multi-year swings.

Commodity funds cover a range of different companies from research and discovery, to extraction, refining and processing, and across oil and a range of industrial and precious metals.

Despite the diversity, the sector as a whole is having a tough time (as we highlighted last week) and has seen 5 straight months of negative returns.

China is a vital driver of demand, but investors fear that the central government’s efforts to clamp down on its debt burden will reduce growth and its appetite for commodities.

The United States’ expanding fracking industry has unlocked the country’s large energy reserves putting more downward pressure on oil prices.

Cutting the fat

Yet, many commodity companies haven’t been idle in the years since Chinese demand faltered and the financial crisis of 2007/8. They have implemented serious cost-cutting measures, as well as paying down big chunks of their outstanding debts.

Companies that have slimmed down, cut the fat and reduced debts will be in much better shape to capitalise on any pick-up in commodity prices, while also being able to improve margins with prices at a low ebb.

Consider JPM Natural Resources and First State Global Resources (the latter having less exposure to oil – see last week).

ACTION FOR INVESTORS

- If we take history as a guide then commodities look very undervalued relative to the US stock market and so are due a bounce.

- However, just because something is unloved doesn’t mean it can’t stay unloved for some time.

- Unlike our “punt” on gold (see more here) any bounce in commodities is a trend we’d expect to play out over a number of years.

FURTHER READING

Chart 1: GSCI/S&P500 ratio:equities expensive, commodities cheap?

Source: incrementum