What’s Hot

- The theme among our big hitters this month is fairly simple, Europe up (UK included).

- Cheap European small-caps attracted buyers, ignoring recessionary concerns.

- UK Equity Income notably outperformed the broader UK market, as that sector tends to have a Value-style bias. This includes sectors that tend to outperform during high inflation, like energy, commodities, and consumer staples.

What’s Not

- The China sector struggled this month. After a 35%+ run from late October to late January, thanks to China’s unlocking, though just in the last week it may have bottomed.

- This “breather” stretched across to other China influenced sectors in Asia and Emerging Markets.

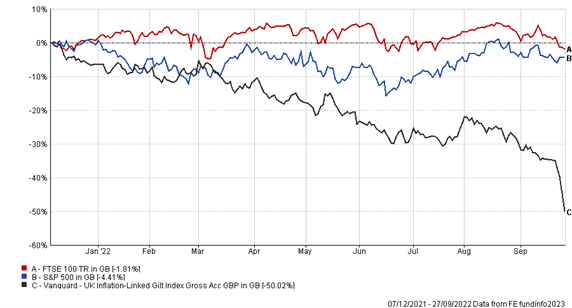

- More concerning is that “Linkers” or UK Index Linked Gilts feature yet again…

- as we have said many times, what often appears “safe” is sometimes nothing of the sort, and particularly so at the end of a 40-year cycle of falling inflation. This is made very obvious by the chart below, depicting the FTSE 100 and S&P 500 vs Vanguard’s UK Inflation Linked Gilt fund during its meltdown last year.

What’s Hot

|

Name

|

Last Month’s Performance %

|

|

European Smaller Companies

|

2.42

|

|

Europe Excluding UK

|

2.13

|

|

UK Equity Income

|

1.93

|

|

UK All Companies

|

1.63

|

|

Europe Including UK

|

1.24

|

What’s Not

|

Name

|

Last Month’s Performance

|

|

China/Greater China

|

-7.38

|

|

UK Index Linked Gilts

|

-5.82

|

|

Asia Pacific Excluding Japan

|

-4.69

|

|

Global Emerging Markets

|

-4.11

|

|

Asia Pacific Including Japan

|

-3.61

|

Performance 01/02/2023 – 28/02/2023

All performance figures quoted as total return in GBP