UK. Confidence intact and growing

Below is our league table of the best UK funds since the election, taking into account the three UK stock market sectors. At the bottom of the table are also shown the two most relevant UK indices (FTSE 100 versus FTSE SmallCap, big companies versus small), and the average of the three sectors.

Table 1: UK funds' performance 12/12/19-12/02/20 (total return)

|

Name

|

Sector

|

Perf. %

|

|

Merian UK Smaller Companies Focus

|

UK Smaller Companies

|

13.8

|

|

Liontrust UK Micro Cap

|

UK Smaller Companies

|

13.5

|

|

Premier Ethical

|

UK All Companies

|

13.4

|

|

Quilter Investors Equity 1

|

UK All Companies

|

13.3

|

|

Threadneedle UK Smaller Companies

|

UK Smaller Companies

|

13.2

|

|

LF Gresham House UK Micro Cap

|

UK Smaller Companies

|

13.2

|

|

Premier UK Growth

|

UK All Companies

|

13.1

|

|

Merian UK Mid Cap

|

UK All Companies

|

13.1

|

|

BlackRock UK Smaller Companies

|

UK Smaller Companies

|

12.5

|

|

Investec UK Smaller Companies

|

UK Smaller Companies

|

12.4

|

| |

|

FTSE 100

|

|

3.8

|

|

FTSE SmallCap ex Inv Co

|

|

9.4

|

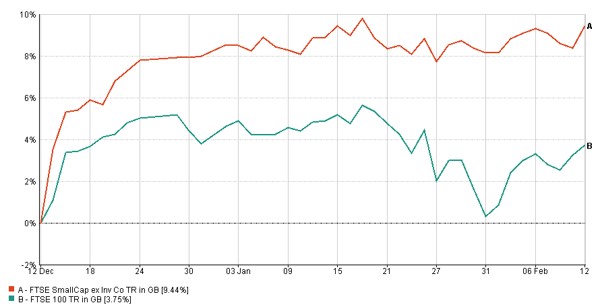

In the graph below you can also see those two indices, and how the FTSE 100 has drifted a bit, while the smaller company index is holding its own.

Although the UK economic numbers for the end of 2019 were flat this was hardly surprising as these are backward looking. The sense of confidence amongst investors and individual companies is now in marked contrast to that prior to the December election.

As JOHCM put it “We continue to expect a meaningful acceleration in the UK economy over the next few months, led by stronger consumer activity”.

That feels right to us. But will it be reflected in the UK stock market? Though it feels contradictory, economies and stock markets do NOT always move in a convenient tandem. We will explore this in more detail in the upcoming Monthly Teleconference for Gold Members – you won’t want to miss this if you aren’t yet a Gold member – details here to upgrade.

China. Virus facts vs market risks

China is an extremely important driver of world growth and global demand, being responsible for one-third of global growth. Closing down large parts of their economy hits not just China, but the world.

The Chief Medical Office (CMO) for England appeared on the Today programme on Thursday morning after the 8am news (you can replay on the BBC Sounds App). Earlier in the week they interviewed experts (all professors in epidemiology) who were relatively relaxed. Mid-week they had the apocalyptic expert, whom I guess is the one feeding the gloom and doom of Ambrose Evans-Pritchard (AEP, Daily Telegraph).

The CMO wanted to rise above the huff and puff of some media coverage, and the wide-ranging views of his peers, and was keen to point out that:

- The Chinese authorities have not been deliberately mis-leading, but the official numbers are simply catching up with the complex facts on the ground, and improving understanding of this virus.

- The great majority of infected people have very mild symptoms.

- Mathematical models are useful for figuring a reasonable worst case [the sort on which AEP is relying?]…

- …But they have no or little value if you feed into the computer entirely speculative numbers and assumptions

- Each year, approximately 8,000 people in the UK die from flu. No one in the UK has died from this coronavirus.

- There is a still a great deal of uncertainty. We must act based on the evidence, but always be prepared for a deterioration.

Turning to stock markets, the Chinese stock market (CSI 300) was down 12% from its high on 13th January. It has now bounced, is down just 5% from that peak, and is still higher than it was in mid-December.

Those of a cynical nature might say this is because the market is being manipulated by the Chinese authorities. OK. So let’s look at other stock markets, bearing in mind that a Chinese economic crisis is very much a problem for the world as a whole.

The FTSE Pacific ex Japan index was down 8%, and is now down just 2.5%. The French market is unchanged, Germany is up a tad, and the UK down 1%.

Some companies are undoubtedly having problems in the short term e.g. car manufacturers closing because they cannot source components. I even encountered this with a small electrical business not far from us, again who sources components from China. The market’s assumption at the moment is that the economic damage can be contained because the virus itself is (or appears to be) being contained.

As the phlegmatic CMO might say, let’s work with the evidence, but be prepared for the worst.

Last week we said hold off on our China recommendations for 2020 and beyond, at least for another week. There is no rush, and my inclination is to continue to sit on my hands, particularly as there are other opportunities to exploit, such as in the UK.

Europe. New highs and new lows?

Europe is obviously impacted by the China virus. For example, China accounts for roughly a quarter of German car sales. But demand was already collapsing towards the close of 2019, before the virus emerged. In December industrial production crashed in the EU, with Germany in particular down 7.2% compared to a month earlier.

The problem for Europe is that this increased uncertainty (economic and political) is occurring at a time when policymakers (central banks and politicians) have limited scope for manoeuvre, more so in Europe than elsewhere.

Christine Lagarde, new boss at the ECB, has set up a review on what the ECB’s role should be in this new decade – this is really a fig leaf enabling the ECB to tell the politicians to get their finger out, take responsibility, and start pumping money into their economies i.e. a huge change in emphasis from monetary to fiscal stimulus. That is fine, and much needed. But if the official conclusions are not published until the Autumn there is a risk of policy paralysis at a time of growing uncertainty, and increasing vulnerability.

In these circumstances it is certainly strange that European stock markets are holding up quite so well, as you saw above. While in Paris in recent weeks it was clear to me that Paris, on the surface a least, is doing rather well – ironically due to a vast flow of Asian tourists. Yet the taxi drivers (the touchstone in so many cities) echoed the yellow vest demonstrators, and those in rural areas, that many ordinary French people simply do not have an adequate living wage.

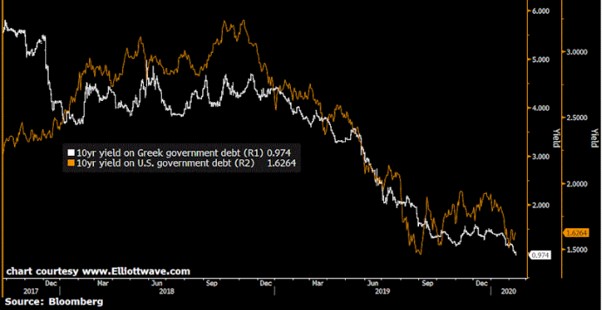

The relaxed tone of European stock markets also reaches across to bond markets...

Beware Greek bonds bearing not-a-lot

If you had a choice between a 10-year bond issued by the US government and one issued by the Greek government, which one would you be inclined to buy?

If you are not sure, let me add a little more detail…

…Which would you buy if the US government bond had a yield of 1.6% and the Greek bond had a yield of 0.9%?

Before answering you are perhaps puzzling over why-oh-why the Greek bond is offering a lower yield, with the implication that there is markedly less risk, both of default and inflation.

Like so much in today’s markets, it is not easy to rationalise. If not a little crazy.

Ireland. Don’t forget political risks!

In a week dominated by news on the coronavirus, the US primaries, and the Trump-like decision by Boris to shaft his Chancellor, you might have overlooked the seismic shift in Irish politics. The surge in votes for Sinn Fein in last week’s election even surprised Sinn Fein – that hadn’t even bothered to field a full allocation of candidates.

Of course, it is mostly seismic for Ireland, not everyone else. Nonetheless, it serves to highlight a very big risk for markets which has certainly not reduced. While Ireland has shifted to the left with Sinn Fein, Italy is shifting to the right, France remains at loggerheads with the yellow vests (and various other groups, as I discovered first hand in recent weeks), and Germany is struggling with another surge by right-wing nationalists.

As in the 1930s, political polarisation means sharp swings to right and left.

FURTHER READING