The death of David Swensen a couple of weeks ago highlighted the importance of challenging lazy orthodoxy. Here I want to explore just that, what we can learn from David, and how his track record stands up.

David Swensen was a man of great integrity, and has been, and will continue to be, a huge influence in certain parts of the investment industry.

First a little background. After graduating from Yale in 1980 with a PhD in economics, he spent a bit of time on Wall Street working for Lehman Brothers and Salomon Brothers. Then Yale came knocking on his door asking him to come and run their endowment fund – and accept an 80% pay cut! [It is ironic that he ended up being Yale’s best-paid employee, with a basic salary of $850,000, and a bonus of a few million dollars more]

He accepted and has been running that huge endowment since 1985 until his death. The fund grew from $1 billion to over $32 billion – this was a big job indeed, and a huge achievement.

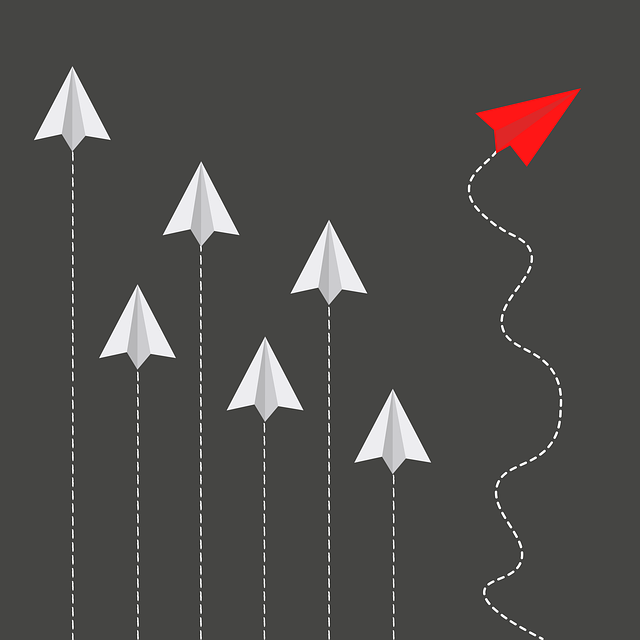

He became most famous for turning the endowment portfolio from something like a conventional 60/40 structure, split between equities and bonds, to something much more unconventional – revolutionary at the time. He went into private equity and venture capital, forestry and hedge funds, leveraged funds and managed futures.

To illustrate how extreme this move was, last year the fund had only 2.5% in US equities.

Charles Ellis said “Swensen changed how everyone who is serious about investing thinks about investing”. Yes, in the narrow area of managing endowments, and some massive pension funds. But not beyond that – and this is where many of his fans miss the true lesson from what David achieved.

But first let’s look at his performance achievement.

The Swensen Premium

David’s unconventional approach achieved a return of 12.4% a year, compared to about 10% from the US stock market. It doesn’t sound much extra, but an extra 2.4% a year, compounded over 35 years makes a massive difference to the size of the fund.

That is what you can achieve when you challenge orthodoxy, though there are always some who will snipe at what he achieved, and try and belittle it.

When I saw those numbers I thought I would double-check what our own methodology has achieved. We have certainly challenged orthodoxy in the retail fund industry – there are a good number who carp about our approach, but they can never challenge the evidence…

- Our Dynamic UK All Companies Portfolio has achieved an extra 5.64% per annum since July 1995 versus the FTSE 100 index. This means that £100,000 grew to £1,869,113 with that Dynamic portfolio, and only £416,115 in an index tracker. An extra £1,452,998.

- Our Dynamic UK Blended Portfolio achieved an extra 10.46% per annum since May 2000. This means £100,000 grew to £1,736,573 with that Dynamic portfolio, and only £203,450 in an index tracker. An extra £1,533,123.

Challenging The Efficient Market Orthodoxy

David took the idea of the Modern Portfolio Theory and extended it into alternative investments, from hedge funds to illiquid woodland, and added a new layer to the Harry Markowitz idea of combining together lots of imperfectly correlated assets.

This pebble in the pond rippled across a vast amount of the investment industry, way beyond the endowment funds where it was intended to have particular relevance. It gave encouragement to those who believe in the efficient market hypothesis, and that the only solution is passive funds.

In particular, within the retail investment industry (which bears no comparison with the endowment sub-sector) it encouraged The Guardians Of Mediocrity. The latter are mostly snake oil salesmen passive fund disciples.

But amongst the Guardians are also many who promote active funds, who take diversification to ridiculous ends. In the last week our advisory team have been reviewing a new client’s portfolio spread across 15 sectors and 34 funds – this is ridiculous. It illustrates how the prior adviser was, essentially, doing no investment research, so had no sense of where the portfolio should be concentrated.

The adviser could justify this by falling back on the idea of diversification – the famous “free lunch”, as even David Swensen stated.

But our experience, and the evidence, in the retail investment industry couldn’t be clearer – this is not so much a free lunch, as a poison chalice which is sure to massively hold back your investing potential – that is not acceptable.

A Game I Don’t Understand

Back in 1969, Warren Buffet stepped away from investing for a short while, sending money back to his investors. He said:

“I am not attuned to this market environment… I don’t want to play a game I don’t understand”.

Recently Swensen also said “I don’t know any other way to invest”.

They both knew their limitations in the context of their well-defined investment sub-sectors.

If either had tried applying their strategy in the retail investment world you would possibly have never heard of either.

Taking a hint from them, what we do is what works in retail investing. You couldn’t do it in a $30 billion fund – among other things there would not be the liquidity to apply a momentum strategy.

But nor can David and Warren do what you do – which is why we devote a chapter in

Clueless to “

Beating Buffett Is Easy”.

What Can We Learn From David?

We can learn much from David Swensen. His integrity, his willingness to challenge orthodoxy, his infectious curiosity, and his discipline. He is a man I would love to have met.

But there is not very much in his endowment investing style which we can apply in the retail investing arena – he did what worked in his field, and with some aplomb.

FURTHER READING