Given how low interest rates are, you probably will not be keen on having over-much in cash. On the other hand, stock markets seem perpetually worrying. But there are alternatives.

Given how low interest rates are, you probably will not be keen on having over-much in cash. On the other hand, stock markets seem perpetually worrying. But there are alternatives.

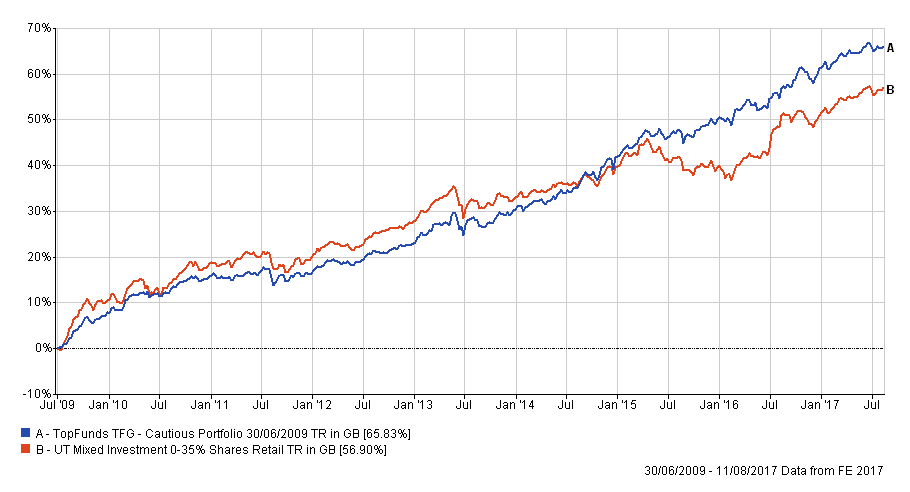

Regular readers will know about our Balanced Portfolio, which we track against equivalent funds from Hargreaves Lansdown and Jupiter. There is also an equivalent Cautious Portfolio, which has also done rather well. It is up 110% since launch in 2004 compared to 69% for the equivalent average fund (from the Mixed 0-35% Shares sector).

The problem with a cautious portfolio is that it is, ironically, more difficult to construct than a riskier portfolio. Whereas we might use Dynamic Fund Ratings to select stock market funds (medium risk), it is seldom as straightforward selecting funds from the lower risk sectors.

Many “lower risk” sectors are fundamentally confused and confusing (such as the Targeted Absolute Return sector). It is not always easy to analyse the funds within each sector.

Plus, even these “lower risk” sectors will still be subject to extremes - as occurred in property and bonds over the last decade.

In a nutshell, we must apply much more judgement.

With this in mind, we dusted off our Cautious Portfolio and here are the current funds:

The BlackRock and Henderson funds are invested into the stock market but can make money whether the market goes up or down - what are called long/short funds.

The Jupiter fund is one of the best of its kind in the Mixed 0-35% sector, which limits its stock market exposure to an upper limit of 35%.

The property fund is a haven of stability (only occasionally stirred, such as at the time of the shock Brexit vote).

And the potential of emerging market bonds is in masterful hands with M&G.

Below, you can see the result compared with the average fund of this kind. Since 30 June 2009 to date our Cautious Portfolio, if it had been invested in these funds, would have been up 66%, approximating 7% per annum. Very respectable. The objective is to provide a decent margin over deposit returns in most years.

It is not meant to track the stock market and it is worth noting that the stock market is six times more volatile.

If you’re keen to reduce your stock market exposure and diversify amongst lower risk funds then is a portfolio to consider.

This is part of a number of powerful new portfolios that will be launched in the autumn, and regularly monitored and updated. Watch this space...

ACTION FOR INVESTORS

- Don’t take more risk than you are comfortable with…

- …and can tolerate

- If in doubt, seek professional financial advice

FURTHER READING

Chart 1: Cautious Portfolio vs. Mixed 0-35% Shares sector