Within FundExpert you will see that each fund has a rating, from 1 Star to 5 Star (click here if you are an income investor). The rating tells you if a fund should be bought (or sold) based on following a Dynamic Fund Selection process using Dynamic Fund Ratings.

For example, in theory a 5 Star rating means a high probability of extra growth compared to average. Moving beyond theory, the sector dropdowns below show you how successful it has been in practice, back to the 1990s.

We tested our Dynamic Fund Ratings sector by sector. Click on a sector below to see how much more growth you could have generated since the 1990s. The charts show the individual 5-year rolling performance for Dynamic Fund Selection (bluebars). The date shown is the end of each 5-year period, so if you see 1 July 2024 in the chart the blue bar shows the performance over the 5-year period from 1 July 2019 to 1 July 2024.

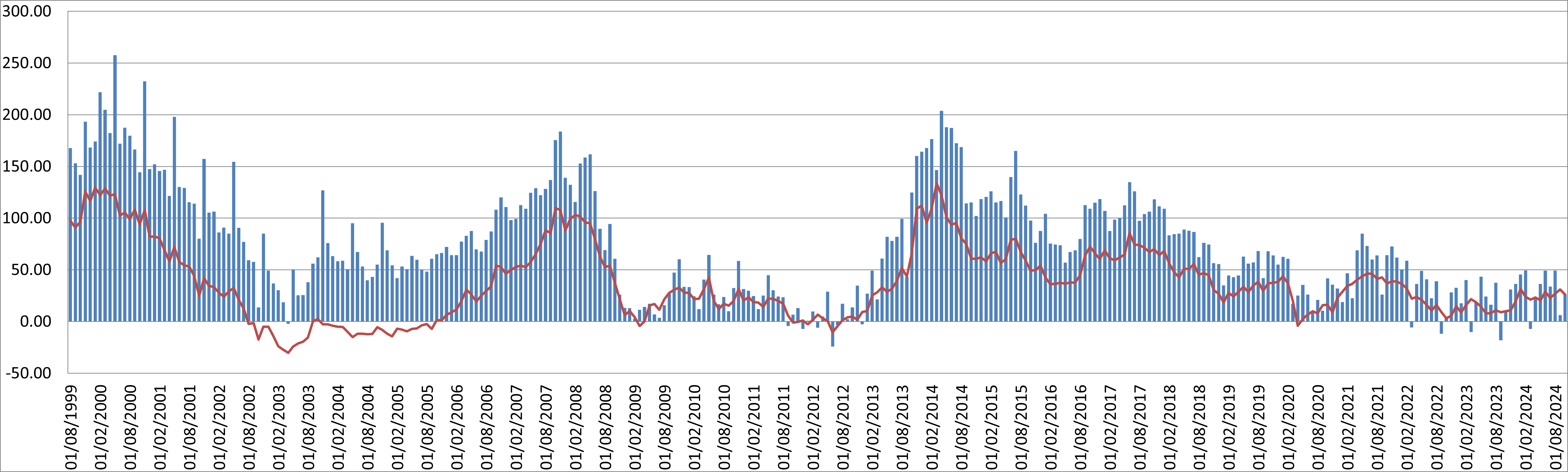

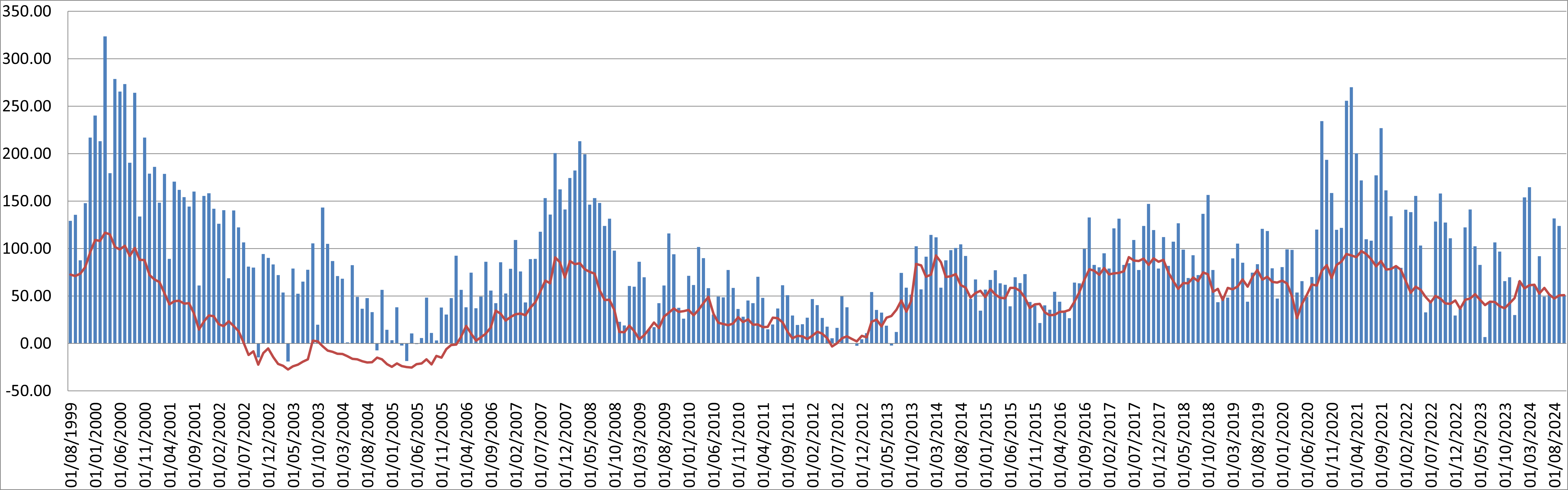

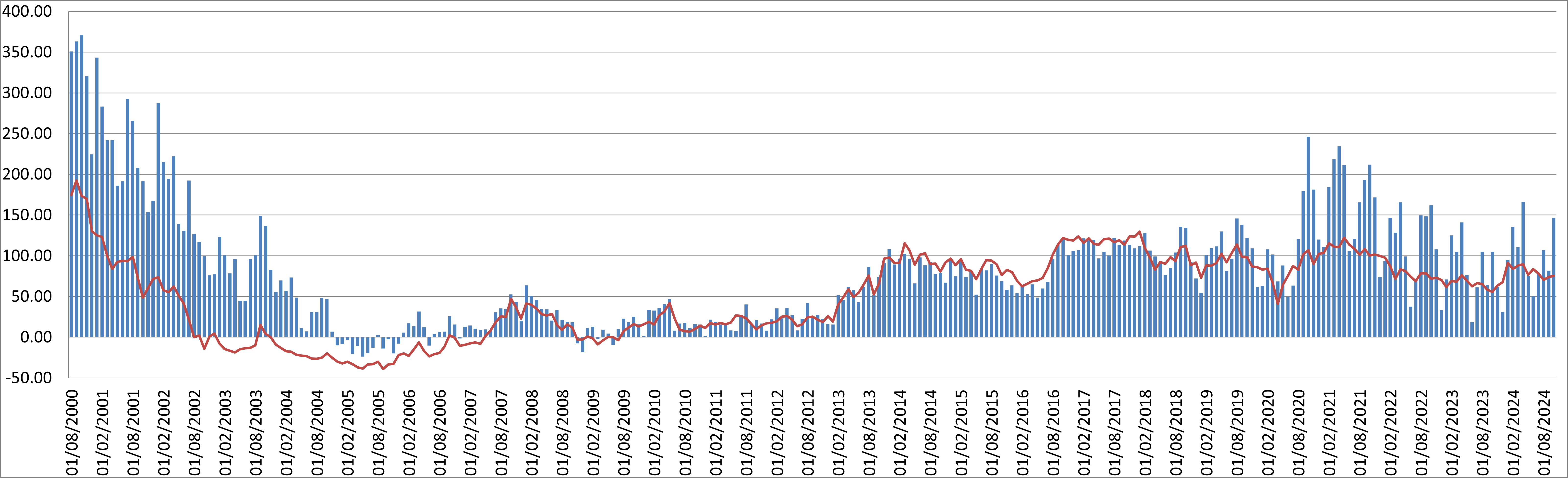

UK All Companies

UK All Companies funds invest at least 80% of their assets in UK equities which have a primary objective of achieving capital growth.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the UK All Companies sector, analysing 303 five year periods since 1999. The results:

- 6.59% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £3,757 average extra return after 5 years – from an £10,000 initial investment

- 89.44% chance of outperformance - Dynamic Fund Ratings outperformed in 271/303 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

UK All Companies - Dynamic Fund Ratings vs. Sector Average Since 1999

(Dynamic Portfolio: blue bars; Sector average: red line)

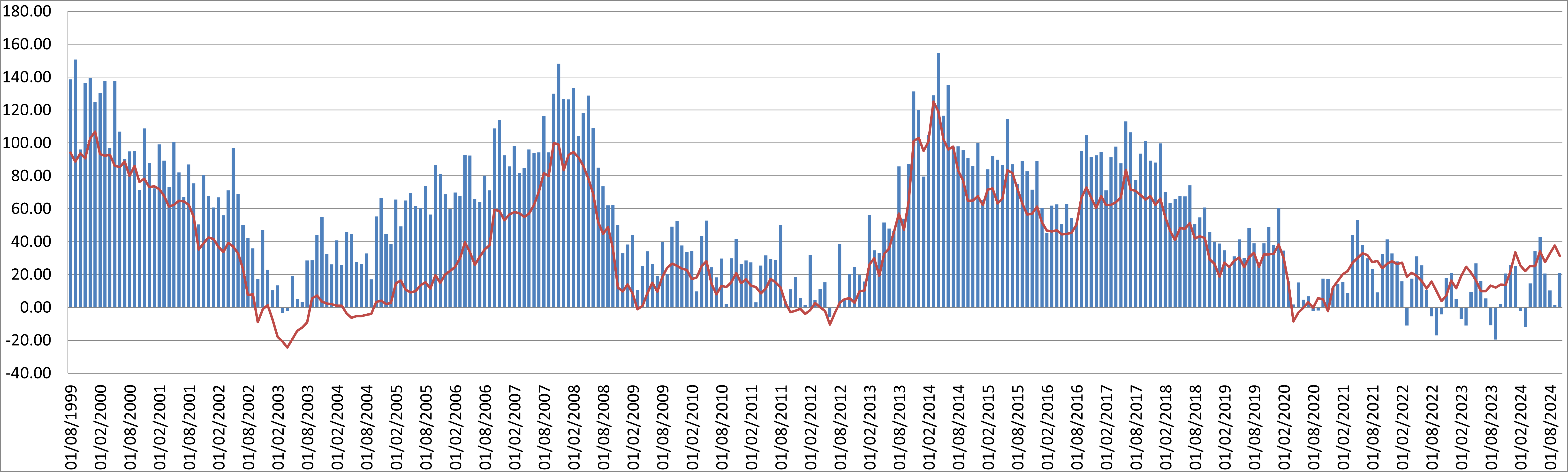

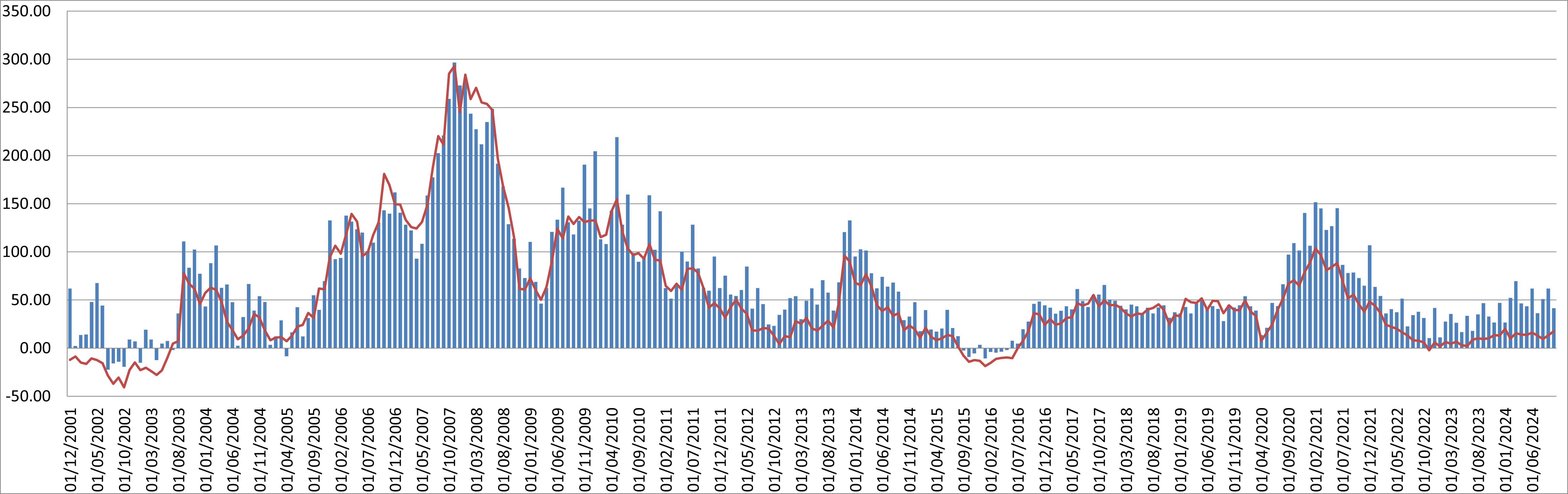

UK Equity Income

UK Equity Income funds invest at least 80% of their assets in UK equities which intend to achieve a historic yield in excess of 100% of the FTSE All Share yield on a 3 year rolling basis.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the UK Equity Income sector, analysing 303 five year periods since 1999. The results:

- 3.49% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,870 average extra return after 5 years – from an £10,000 initial investment

- 87.13% chance of outperformance - Dynamic Fund Ratings outperformed in 264/303 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

UK Equity Income - Dynamic Fund Ratings vs. Sector Average Since 1999

(Dynamic Portfolio: blue bars; Sector average: red line)

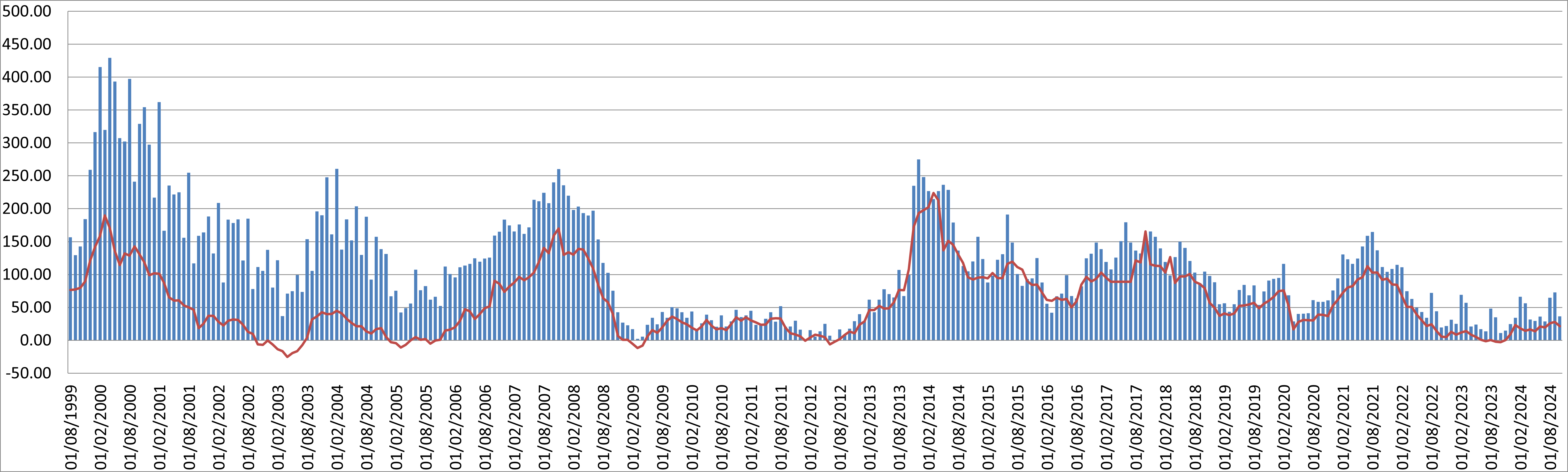

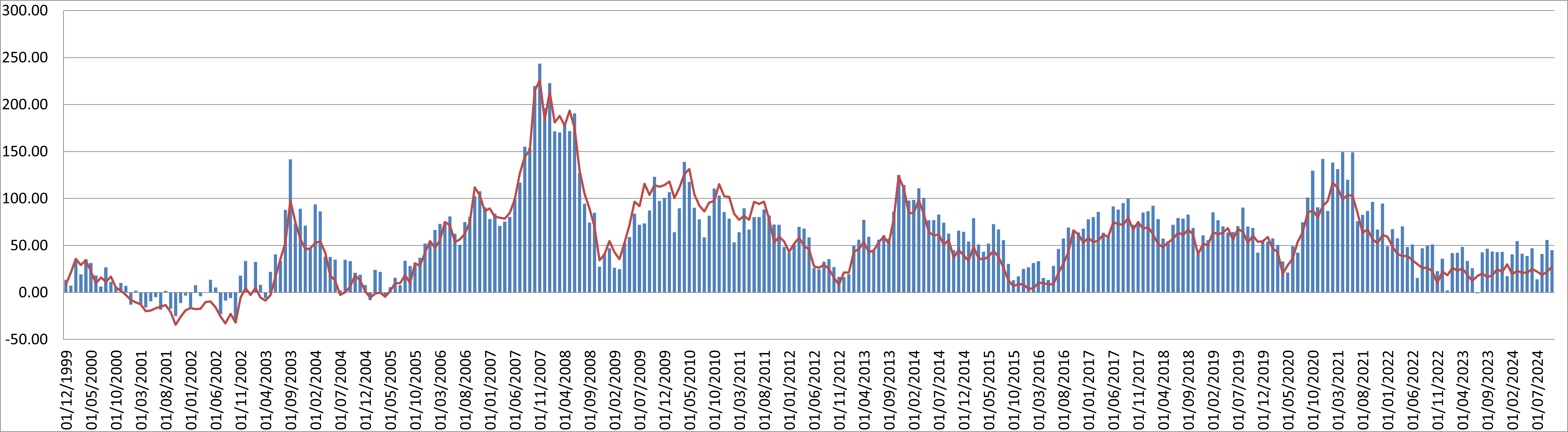

UK Smaller Companies

UK Smaller Companies funds invest at least 80% of their assets in equities of UK companies which form the bottom 10% by market capitalisation.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the UK Smaller Companies, analysing 303 five year periods since 1999. The results:

- 9.18% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £5,510 average extra return after 5 years – from an £10,000 initial investment

- 93.07% chance of outperformance - Dynamic Fund Ratings outperformed in 282/303 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

UK Smaller Companies - Dynamic Fund Ratings vs. Sector Average Since 1999

(Dynamic Portfolio: blue bars; Sector average: red line)

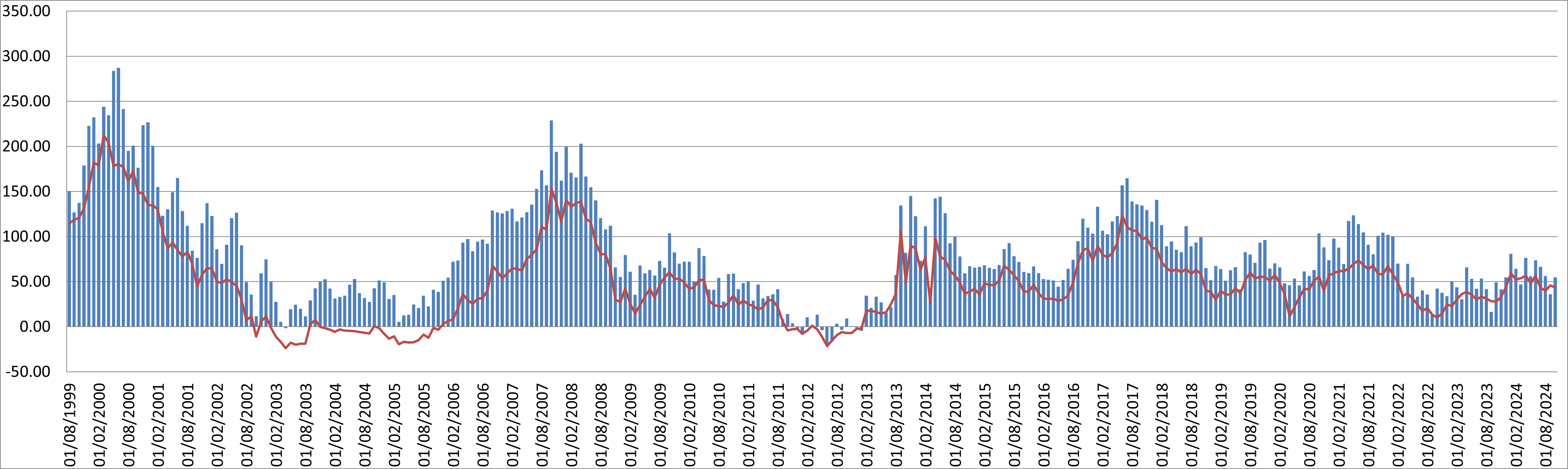

Europe ex-UK

Europe ex-UK funds invest at least 80% of their assets in European equities and exclude UK securities.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Europe ex-UK sector, analysing 303 five year periods since 1999. The results:

- 5.66% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £3,172 average extra return after 5 years – from an £10,000 initial investment

- 96.04% chance of outperformance - Dynamic Fund Ratings outperformed in 291/303 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Europe ex-UK - Dynamic Fund Ratings vs. Sector Average Since 1999

(Dynamic Portfolio: blue bars; Sector average: red line)

Global

Global funds invest at least 80% of their assets globally in equities. Funds must be diversified by geographic region.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Global sector, analysing 303 five year periods since 1999. The results:

- 7.98% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average Global fund

- £4,677 average extra return after 5 years – from an £10,000 initial investment

- 86.14% chance of outperformance - Dynamic Fund Ratings outperformed in 261/303 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Global - Dynamic Fund Ratings vs. Sector Average Since 1999

(Dynamic Portfolio: blue bars; Sector average: red line)

Global Emerging Markets

Global Emerging Markets funds invest at least 80% of their assets in emerging market equities.

How effective is Dynamic Fund Ratings in this sector?

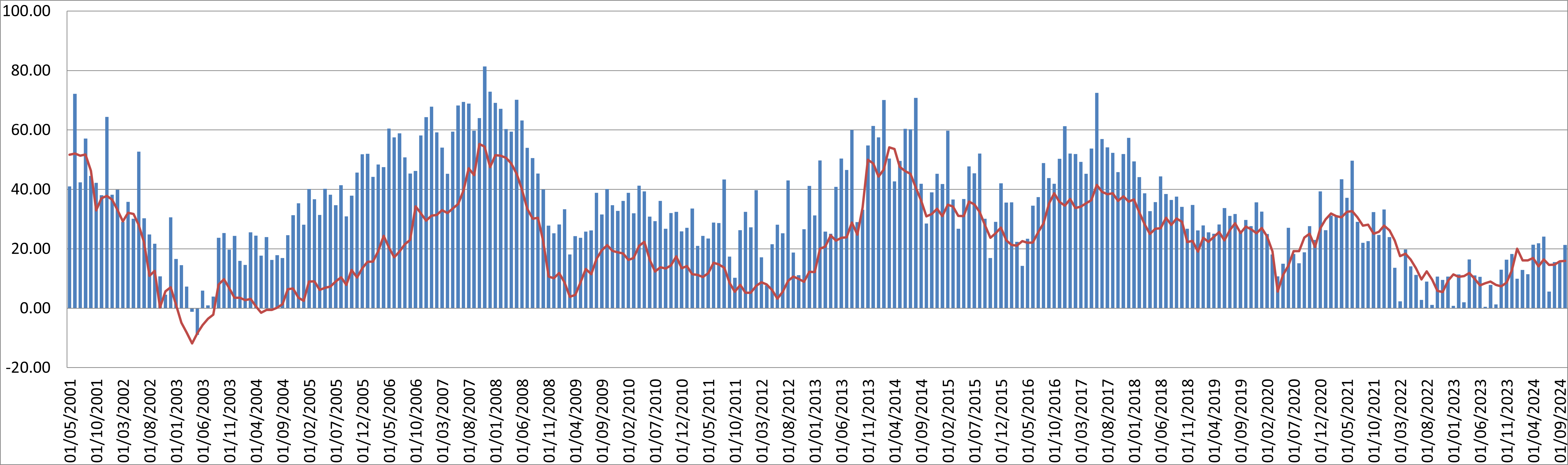

We tested the effectiveness of Dynamic Fund Ratings within the Global Emerging Markets sector, analysing 275 five year periods since 2001. The results:

- 2.94% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,562 average extra return after 5 years – from an £10,000 initial investment

- 80.36% chance of outperformance - Dynamic Fund Ratings outperformed in 221/275 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2001. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Global Emerging Markets - Dynamic Fund Ratings vs. Sector Average Since 2001

(Dynamic Portfolio: blue bars; Sector average: red line)

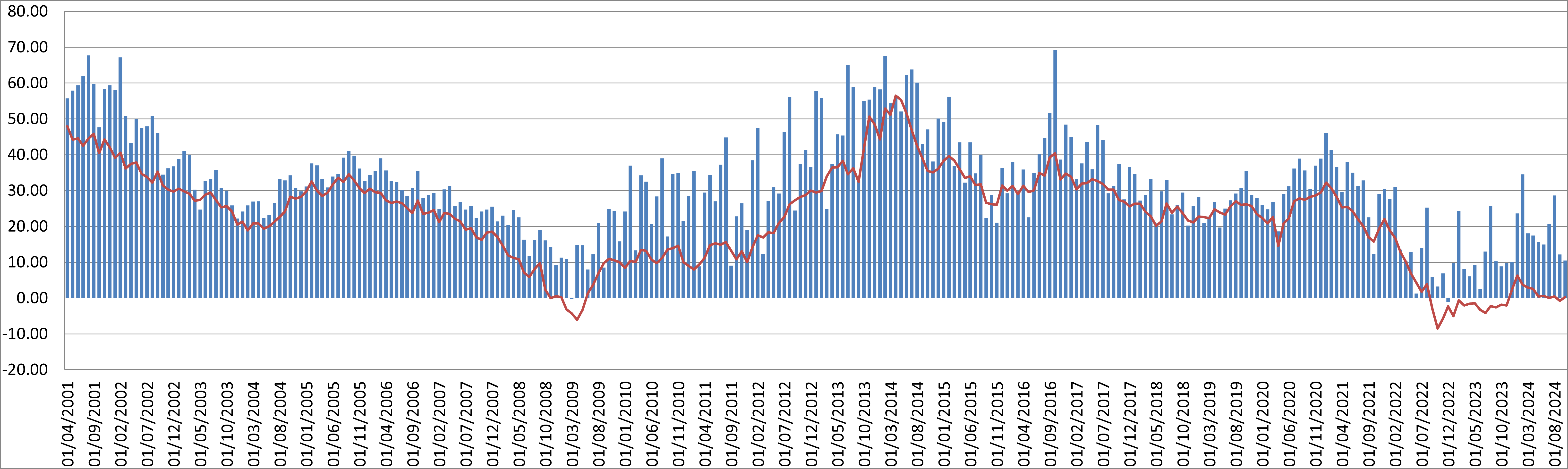

Asia Pacific ex-Japan

Asia Pacific ex-Japan funds invest at least 80% of their assets in Asia Pacific equities and exclude Japanese equities.

How effective is Dynamic Fund Ratings in this sector?

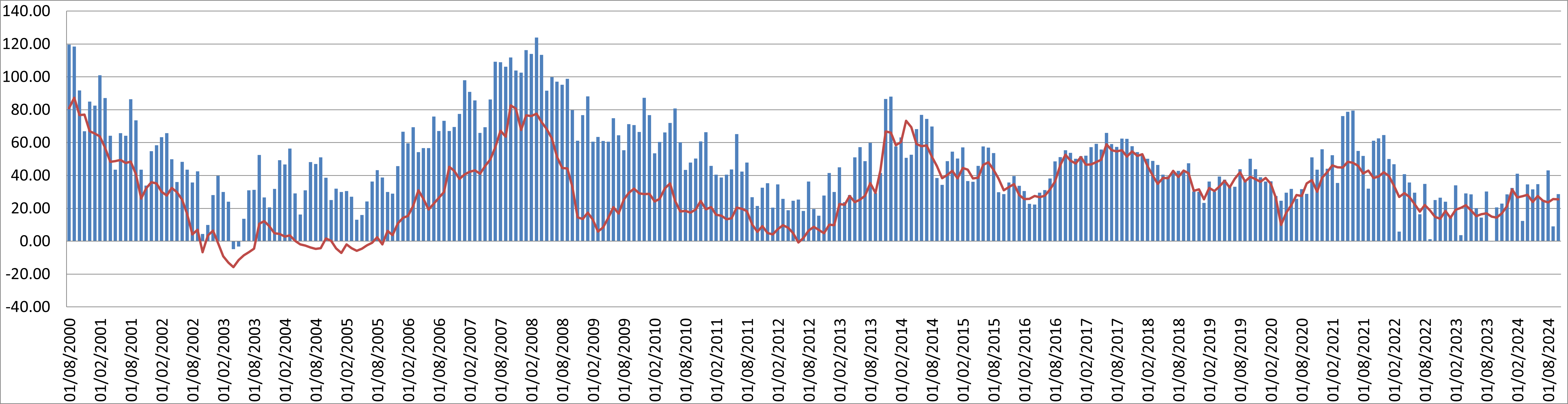

We tested the effectiveness of Dynamic Fund Ratings within the Asia Pacific ex-Japan sector, analysing 299 five year periods since 1999. The results:

- 1.67% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £863 average extra return after 5 years – from an £10,000 initial investment

- 73.24% chance of outperformance - Dynamic Fund Ratings outperformed in 219/299 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 1999. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

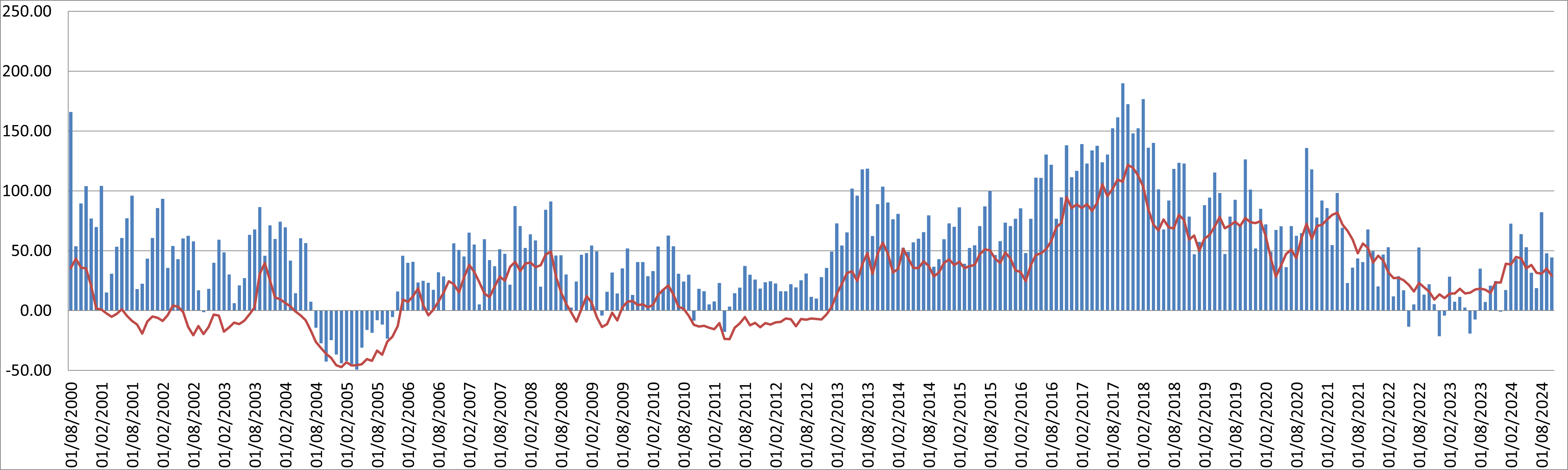

Asia Pacific ex-Japan - Dynamic Fund Ratings vs. Sector Average Since 2000

(Dynamic Portfolio: blue bars; Sector average: red line)

Japan

Japan funds invest at least 80% of their assets in Japanese equities.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Japan sector, analysing 291 five year periods since 2000. The results:

- 4.98% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £2,752 average extra return after 5 years – from an £10,000 initial investment

- 87.29% chance of outperformance - Dynamic Fund Ratings outperformed in 254/291 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2000. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Japan - Dynamic Fund Ratings vs. Sector Average Since 2000

(Dynamic Portfolio: blue bars; Sector average: red line)

North America

North America funds invest at least 80% of their assets in North American Equities.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the North America sector, analysing 291 five year periods since 2000. The results:

- 5.29% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £2,941 average extra return after 5 years – from an £10,000 initial investment

- 70.79% chance of outperformance - Dynamic Fund Ratings outperformed in 206/291 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2000. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

North America - Dynamic Fund Ratings vs. Sector Average Since 2000

(Dynamic Portfolio: blue bars; Sector average: red line)

Sterling Corporate Bond

Sterling Corporate Bond funds invest at least 80% of their assets in Sterling denominated corporate bond securities, rated Triple B minus or above.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Sterling Corporate Bond sector, analysing 282 five year periods since 2001. The results:

- 1.74% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £900 average extra return after 5 years – from an £10,000 initial investment

- 92.23% chance of outperformance - Dynamic Fund Ratings outperformed in 261/282 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2001. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Sterling Corporate Bond - Dynamic Fund Ratings vs. Sector Average Since 2001

(Dynamic Portfolio: blue bars; Sector average: red line)

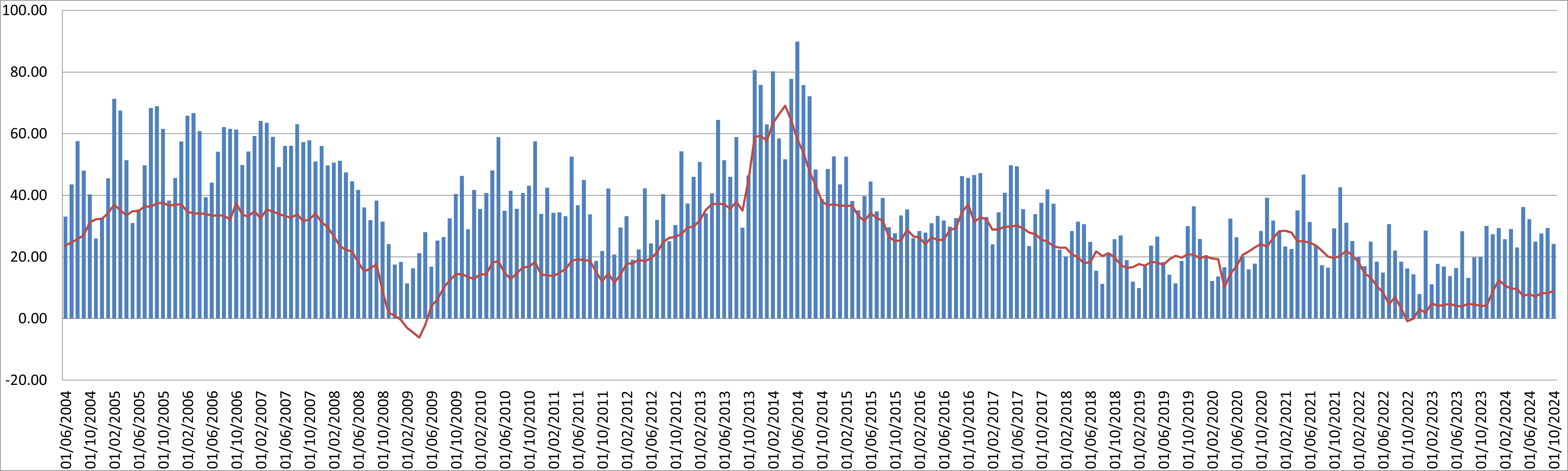

Sterling Strategic Bond

Sterling Strategic Bond funds invest at least 80% of their assets in sterling denominated fixed income securities.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Sterling Strategic Bond sector, analysing 245 five year periods since 2004. The results:

- 2.50% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,316 average extra return after 5 years – from an £10,000 initial investment

- 87.35% chance of outperformance - Dynamic Fund Ratings outperformed in 214/245 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2004. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Sterling Strategic Bond - Dynamic Fund Ratings vs. Sector Average Since 2004

(Dynamic Portfolio: blue bars; Sector average: red line)

Flexible Investment

The funds in this sector are expected to have a range of different investments. However, the fund manager has significant flexibility over what to invest in. There is no minimum or maximum requirement for investment in company shares (equities) and there is scope for funds to have a high proportion of shares.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Flexible Investment sector, analysing 291 five year periods since 2000. The results:

- 3.12% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,660 average extra return after 5 years – from an £10,000 initial investment

- 82.13% chance of outperformance - Dynamic Fund Ratings outperformed in 239/291 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2000. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Flexible Investment - Dynamic Fund Ratings vs. Sector Average Since 2000

(Dynamic Portfolio: blue bars; Sector average: red line)

Mixed 20-60% Shares

Funds in this sector are required to have a range of different investments. The fund must have between 20% and 60% invested in company shares (equities). At least 30% of the fund must be in fixed income investments (for example, corporate and Government bonds) and/or “cash” investments. “Cash” can include investments such as current account cash, short-term fixed income investments and certificates of deposit.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Mixed 20-60% Shares sector, analysing 282 five year periods since 2001. The results:

- 2.31% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,211 average extra return after 5 years – from an £10,000 initial investment

- 84.40% chance of outperformance - Dynamic Fund Ratings outperformed in 238/282 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2001. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Mixed 20-60% Shares - Dynamic Fund Ratings vs. Sector Average Since 2001

(Dynamic Portfolio: blue bars; Sector average: red line)

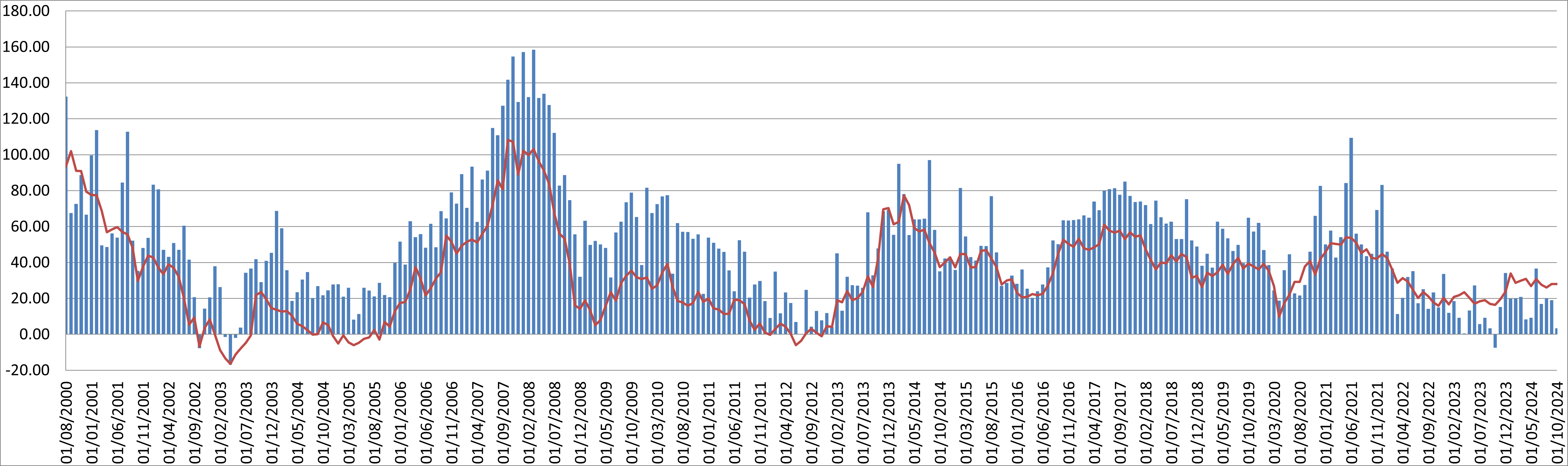

Mixed 40-85% Shares

Funds in this sector are required to have a range of different investments. However, there is scope for funds to have a high proportion in company shares (equities). The fund must have between 40% and 85% invested in company shares.

How effective is Dynamic Fund Ratings in this sector?

We tested the effectiveness of Dynamic Fund Ratings within the Mixed 40-85% Shares sector, analysing 291 five year periods since 2000. The results:

- 3.60% extra growth per annum - achieved by the Dynamic Fund Ratings vs the average sector fund

- £1,933 average extra return after 5 years – from an £10,000 initial investment

- 87.63% chance of outperformance - Dynamic Fund Ratings outperformed in 255/291 five year periods

This is illustrated in the chart below. The blue columns represent the return of Dynamic Funds Ratings for each five year period since 2000. The red line represents the sector average. Wherever the blue column is higher than the red line Dynamic Fund Ratings outperformed the sector average.

Find the best momentum funds by searching for the sector here.

Mixed 40-85% Shares - Dynamic Fund Ratings vs. Sector Average Since 2000

(Dynamic Portfolio: blue bars; Sector average: red line)