Where to start? The election of Donald Trump instantly injected extreme volatility into world financial markets. China went down sharply (fear of Trump tariffs), then up sharply (they won’t take it lying down). The UK cut rates, but with the warning of new inflation risks, and rates not going down as much as many hoped in 2025.

Where to start? The election of Donald Trump instantly injected extreme volatility into world financial markets. China went down sharply (fear of Trump tariffs), then up sharply (they won’t take it lying down). The UK cut rates, but with the warning of new inflation risks, and rates not going down as much as many hoped in 2025.

Germany, already in a mess economically, is now politically in tatters, the Minister of Finance having been sacked. But European equities, including Germany and the UK, held steady, presumably in the hope for rate cuts. But for China, there was little change across Asia.

Gold fell sharply on Wednesday, while copper and oil were notably higher. Longer-dated UK government bonds (gilts) fell sharply, and US government bonds were under pressure too – not just fear of inflation, but also concern over the huge pipeline of new debt added to a debt mountain which already feels unsustainable.

A new strand of volatility is now assured for the years just ahead. Partly it is because there is a degree of certainty on some Trump policies (e.g. tariffs), and partly because that still leaves a large sheet of blank paper which Trump can fill in on a whim.

One widely held working assumption of recent days is that if Trump has a clean sweep (with his Republican Party controlling both houses of Congress) this will be good for the US stock market as Trump will have free rein e.g. unfunded cuts in corporation tax, and spending freely. What tends to be overlooked is the prevailing over-valuation of the US stock market, more expensive than 1929, though perhaps not yet as expensive as 1999/2001 (which is hardly a ringing historical endorsement).

It is probably better to turn this around. History informs us all that current US valuations mean we should expect a “lost decade” for the US stock market. Yet in the short term, as we have already encountered this week, markets are emotionally driven.

The problem for investors is not knowing when the short term will catch up with the long term. When will manic turn to panic, as over-confident investors into US equities encounter that Wile E. Coyote moment, when they look down and realise that they have enthusiastically charged over a cliff – and that it is a long way down.

There is no point speculating at length on the possible timing of that revelatory moment. Nonetheless, do look out for the yield on long dated US Treasuries keeping edging up. Currently at 4.7%, if it breaks up through 5% more and more investors will be asking “why am I still invested in the most expensive US stock market in history, bar one, when I can get an assured 5% elsewhere?”.

Gold fell nearly 4% on the US election news. As Treasury yields went up, gold, which generates no income, appeared less attractive. This was a knee-jerk reaction. What has actually moved gold over the last year or two, particularly in 2024, remains the subject of lively debate. Ambrose Evans-Pritchard explored the more conspiratorial angles and his sub-editor went to town with this headline:

“Gold’s mystery rally is a forewarning of fiscal ruin and global dystopia”

(Telegraph, 5th November)

There do appear to be some strange buying patterns. As AEP points out, half the gold purchases since March cannot be traced back to an end buyer, trades taking place through proxies.

Yet, as said on 25th October, most of the time no one really knows what drives the gold price, not with any useful precision, this being “the most enigmatic financial asset in a financial universe which is already highly complex.”

In his victory speech Trump said “This will truly be the golden age of America.” What feels more likely is that we are in an age of gold.

Returning to the UK, investors have been a bit battered in the last fortnight. Don’t get me wrong, it’s not because the UK stock market is obviously in trouble. Rather it is cumulative concerns. It was hoped that a new Labour government might bring stability, but since the Budget it has increased concerns for many investors.

If you hold investments outside ISAs and SIPPs, you will probably not just be paying Capital Gains Tax, but should expect to be paying even more in the years to come. This was expected.

Inheritance Tax (IHT) is a nasty tax. The very wealthy largely avoid it, and those who have to pay up have typically accumulated some wealth on which they were already taxed during their life, or have accidentally benefitted from rising house prices. In 2015 one small concession was introduced – your SIPP or pension fund became inheritable without any IHT being due. This will now be subject to a Government smash-and-grab on your death after 2027.

It is the changes for farms and small businesses which are particularly nasty, and totally without economic merit…

…If you own a farm or small business, and had hoped it would remain a going concern after your death, employing people and paying taxes, the odds that it will survive you are now slim. Despite such businesses typically not running with the luxury of a cash stash, there is now going to be a tax smash-and-grab on death from which many farms and small businesses cannot survive.

The hope for a new government bringing stability has been replaced by a fundamental lack of trust. This will not help consumer or business confidence nor the buoyancy of the economy. How much will CGT rise? What is the next hit on SIPPs? Will ISAs survive the next year or two unscathed?

In coming weeks my colleagues at Dennehy Wealth will produce a series of notes to assist with a range of financial planning issues arising from the Budget. The first is “How To Avoid Capital Gains Tax Without Limit”, for those who have taxable investments in addition to their ISAs and SIPPs. It’s a clear, concise read, and not one to miss.

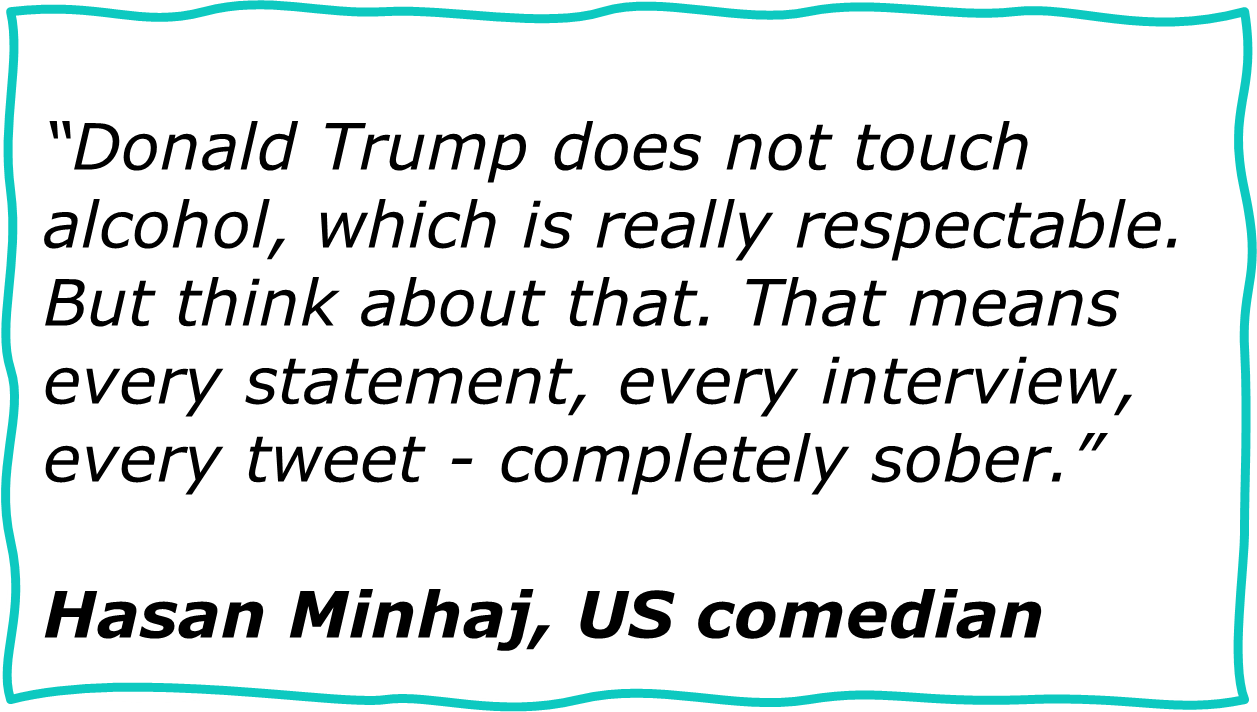

Inevitably I must end with Trump. Did you spot that The Guardian is offering counselling to its staff following the “upsetting” Trump victory? You don’t need to be a Guardian reader to feel a bit out of sorts. I had a coping mechanism when Trump appeared on TV in recent months. I imagined Trump was in Pantomime being played by Julian Clary – it worked. But I fear I can’t do it for another four years, so if you have any alternative suggestions do ping them through.

P.S. China has announced the latest instalment of its huge economic fix. It was in the category of “good enough for now”, and these reforms will keep rolling through 2025. There are already signs of improvement (e.g. house sales, consumer activity, and generally improving business conditions) but this momentum must be maintained. The FT coverage is here, and the comments are particularly entertaining, though not as much fun as Julian Clary in Panto this Christmas.