On numerous occasions in the last small number of years, I have highlighted that a significant number of quoted U.K. companies are cheap. This is mostly just a matter of doing the maths. But whether anyone buys into this value is a matter of confidence and time perspective. Here is how that has evolved in 2022 so far.

Fund managers who have a Value style (they buy what is cheap without good reason) will invest in a company based on the maths. They are not in a hurry and will wait for the wider army of investors, driven more by confidence than maths, to recognise the opportunity, and drive the price higher.

If this moment of confidence does not arise any time soon, the likelihood of a takeover bid rises, whether from a private equity firm or competitor or otherwise. These are also people who focus on the maths.

The value amongst U.K. companies is spread across all capitulations, and it is interesting to see how the different market segments have performed so far this year.

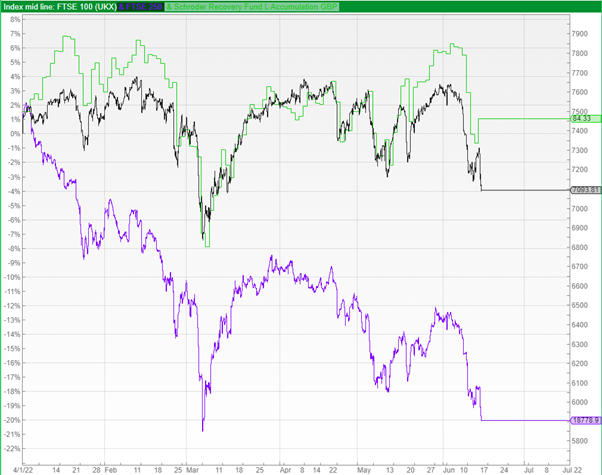

As illustrated in the teleconference, the FTSE 100 has performed rather well in a global context. The chart below shows you that the FTSE 100 index (black line) is down only 3%, whereas the FTSE 250 (purple) is down 20%, almost the same as the S&P 500 index (green).

A number of those big global businesses in the FTSE 100 index are not just cheap, but also exposed to oil and commodities, which have been on a bit of a tear this year.

In contrast, the FTSE 250 has a more domestic focus. Companies might be cheap, but stock market investors are not buying it. Turning to the S&P 500, that is tumbling because it was very expensive, and sharply rising interest rates and inflation have, at last, given US investors pause for thought.

Those UK-based oil and commodity stocks have benefitted both because the maths says they are cheap, and because confidence has grown in this sector of the market.

Judging by the FTSE 250 falls, that confidence has certainly not been evident in the mid-sized UK companies. But as prices tumble, and those stocks get cheaper, it is those driven by the maths who interest perks up – like the shaded lion, waiting patiently for the prey to come into view.

As such it is no surprise that in May, UK takeover activity across UK plc remained robust. 27 plc’s were under offer compared to the record of 32 in August 2021. Private equity firms dominated the bidders, as value continues to emerge in spite of financing costs going up. Looking at it another way, it is because interest rates are going up that company share prices are falling, making them appear even more of a bargain to bidders.

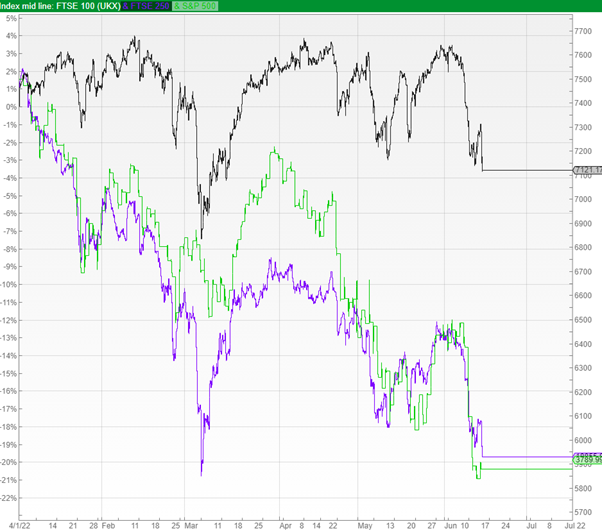

All of this activity makes chunky profits for fund managers, particularly Value-style managers. In chart 2 we have replaced the S&P 500 with Schroder Recovery, the leading UK Value-style fund. You can see that the Schroder fund (green line) is up a little for the year – impressive in the circumstances.

It would not be a shock if this takeover activity quietened a bit over the Summer, allowing economic events to unfold, and the private equity titans to retire to the South of France for a well-earned rest.

But we will keep an eye on these trends, and report back.

Chart 1: FTSE 100 versus FTSE 250 versus S&P 500 (year to date)

Chart 2: FTSE 100 versus FTSE 250 versus Schroder Recovery (year to date)