As we are all aware, COVID-19 affected nearly all areas of life, and small companies across the globe were no exception. But are these smaller companies still a hot prospect for investors, and just how much did the pandemic impact them?

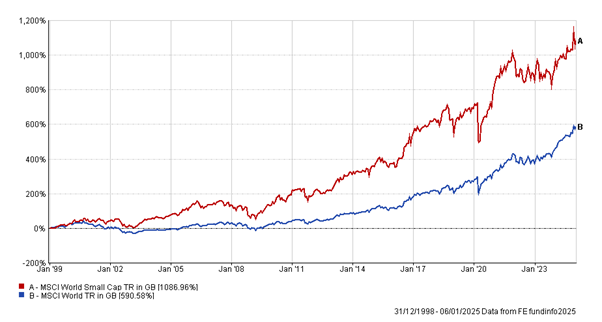

These are not questions with simple answers. Instead we aim to explore them throughout today’s note. Global small caps deserve respect as a long-term investment strategy, demonstrating consistency, reliability and ability to grow at a faster rate than their larger counterparts (see Chart 1 below).

The data speaks for itself. Using the MSCI World Small Cap Index versus the MSCI World Index since January 1999, the MSCI Small Cap Index has posted a 1,086% return versus 590% for its big brother. It shows clearly how smaller companies across the globe have significantly outperformed larger companies over the long-term.

Chart 1: MSCI World vs MSCI World Small Caps since January 1999

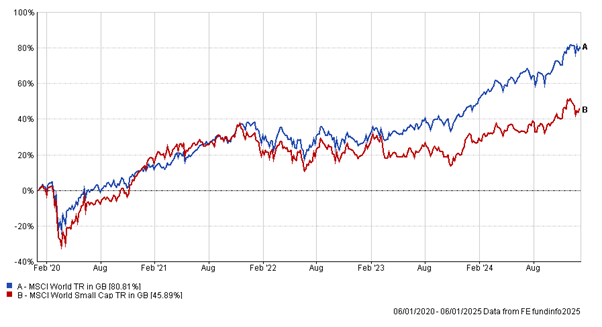

However, over the last five years this pattern has shifted, and the returns of small companies have started to slow down when compared to the large cap index. We can see this as we zoom into the most recent five-year period below in Chart 2. We will touch on potential reasons for this reversal later on.

Chart 2: MSCI World vs MSCI World Small Caps 2020-2025

Given this interesting trend reversal, we wanted to test how our standard Dynamic Fund Selection faired in this Global Small Cap space. Here’s what we did:

- Created a universe from the following mainstream smaller companies sectors; North American Smaller Companies, UK Smaller Companies, European Smaller Companies & Japan Smaller Companies (the latter is no longer a sector but funds with a small cap focus can be easily identified)

- Selected the best 3 funds from the above sectors, with the proviso that each fund must be from a different sector. For example, if the top 3 funds were from the UK Smaller Companies sector, we can only pick the best performing fund, and then select the next best fund not from this sector

- We hold these funds for the next 6 months, and then we purchase the best performing 3 funds over the most recent 6-month period

- We did this with a January/July review cycle, starting back in 1999 and up to January 2025

What did we find?

The results shown in Chart 3 below are fascinating. Our Dynamic Global Smaller Companies portfolio (green line) clearly outperforms the MSCI index (red line) for a significant chunk of the period, namely between 2004-2020, reiterating the case for using our powerful Dynamic fund selection process with this niche investment focus.

Chart 3: Dynamic Global Smaller Companies versus MSCI World Small Cap

But since 2021, as you can see the story changed. We can see a sharp decline for both our process and our external benchmark because of the COVID-19 pandemic. Both have tried to bounce back successfully, but to what extent have they succeeded?

Chart 4 focuses on the last five years, aiming to show how the index and our Dynamic Portfolio performed since 2021. The results show the index returning 45% and the Dynamic Portfolio 11% over the period.

Chart 4: Dynamic Global Smaller Companies versus Global Small Cap Index 2020-2025

So, what have we seen from our above analysis?

- Small caps consistently outperform large caps over the long-term, but in the past 5 years the large caps have far outperformed their smaller counterparts.

- Our Dynamic Global Smaller Portfolio consistently outperforms the benchmark over the long-term, but over the past 5 years this trend has reversed, causing our Dynamic Portfolio to lag behind the benchmark in recent years.

What has caused this reversal in the past 5 years?

Let's start with number 1 above. In the wake of the pandemic, governments across the world needed to inject their economies with cash and encourage spending by lowering interest rates and loosening monetary policy. By cutting interest rates to as low as 0-0.5%, this encouraged smaller companies to borrow, raise debt levels and expand, the short-term effects of which can be seen by the sharp recovery in 2021.

However, as we are all aware, the glory days of 0-0.50% rates came to an end, and rates rapidly rose. This once cheap debt suddenly became a burden and ate into their (relatively small) balance sheets, making it harder for these smaller companies to service this debt.

Turning to point 2 above, why did our Dynamic Portfolio see their outperformance reverse since 2021? The MSCI World Small Cap Index is a benchmark for small companies across the world, and it is a fact that it has a large bias to the US, out of almost 4000 constituents, North American funds make up 63% of the index.

When this is put up against our portfolio, which is an equal 33% split of the top performing funds from three different countries, the benchmark outperforms our portfolio. Remember, we can only have a maximum allocation to any one country of 33%, as we pick the top 3 funds from different sectors.

American small caps are generally larger, more powerful and better positioned to navigate challenges compared to counterparts in other regions. This resilience allowed them to weather the effects of the pandemic more effectively and recover more swiftly. A significant factor has also been The Magnificent Seven effect: even within the small-cap universe, the strength of dominant US mega-cap companies has trickled down, supporting US mid and small caps and overshadowing smaller companies in other regions. Elsewhere, much of Europe, Japan & the UK have struggled to keep up with American exceptionalism since 2021.

Summary

It’s clear that small caps retain their long-term appeal for investors who can tolerate short-term volatility.

Historical data (Charts 1 and 3) shows their potential to outperform larger companies consistently over decades.

While recent years have favoured larger companies in the US and across the globe, our Dynamic Global Small Caps portfolio is an exciting option offering a diversified and disciplined strategy that has great potential to be prosperous in the long run, and now may even be a solid entry point.

You can always follow this portfolio yourself using our tools on the website, namely the Best Funds By Sector tool, and selecting which sectors to pick your funds from. Nonetheless, if you would like to see the Dynamic Global Smaller Companies portfolio officially added to our selection of Dynamic Portfolio’s, please let us know and we can add it in the coming months.