Are you aged under 30? You go to work day after day to make money. How about using that money to make more money? That’s investing. Learn how to invest and possibly in a way which could transform your life, or at the very least your financial well-being.

Are you aged under 30? You go to work day after day to make money. How about using that money to make more money? That’s investing. Learn how to invest and possibly in a way which could transform your life, or at the very least your financial well-being.

Investing is the key to transforming your hard-earned money into a substantial nest egg. You work hard to earn your salary, now make it work hard for you.

There is no magic here. No smoke and mirrors. No stupid risks! In this blog I will show you how – it can also be fun!

Why Invest And How Much?

When you are in your 20’s you probably don’t have much or any money as a lump sum, aside from savings for a deposit for your own place – keep this money safe in a deposit account. But if you can commit a portion of your monthly income to investments, it can make a huge difference.

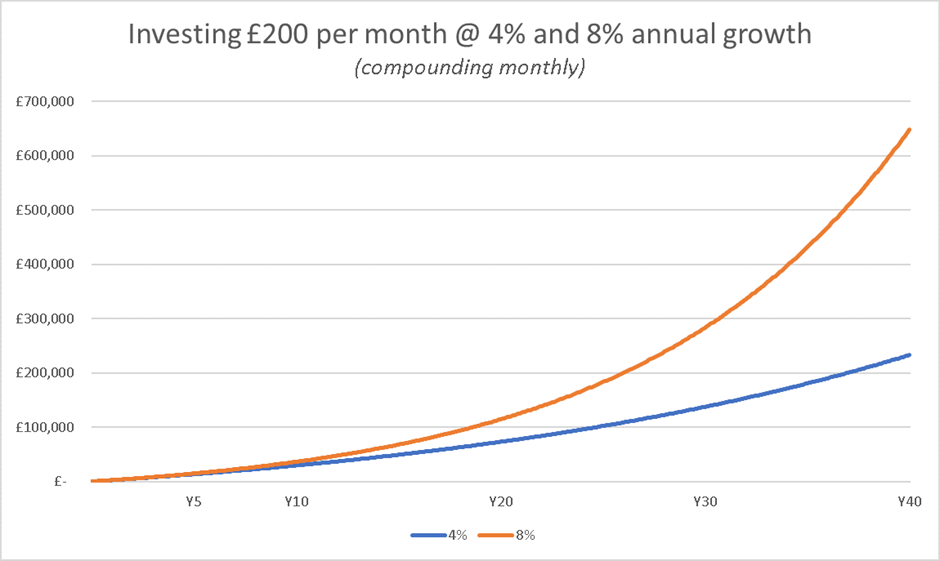

Let's assume you invest £200 per month and explore the potential growth rates of 4% and 8% annually (I will come back to the issue of what growth you might expect on that money, with different strategies).

Visualizing Growth Potential:

To help you grasp the growth potential, below is a graph showing you the massive difference in how your money grows depending on the year-on-year percentage growth. You can also see vividly how this gap widens hugely as time goes on – this is the power of compounding.

To make it easier to see points in time, below is a table. After 10 years you can see that the value is now in the region of two years of your net salary! I repeat, that is after just 10 years. Fancy a gap year in your 30’s? You’ve just made that possible.

|

Years

|

4% growth (£)

|

8% growth (£)

|

|

5

|

13,479

|

14,883

|

|

10

|

29,635

|

36,457

|

|

20

|

73,207

|

114,732

|

|

30

|

137,703

|

283,723

|

|

40

|

233,173

|

648,561

|

I hope that has got your attention.

Motivation For Investing:

You might already be excited by the potential for making a million – fast.

Or you are less excited in the short term, but know long term saving makes sense – perhaps your parents drummed this into you, as have most parents for generations past.

Either way, before you jump to do anything, do some basic groundwork. It’s nothing too heavy, but before you invest you do need to learn some basics. These two blogs will be a huge help in that regard:

1. The fundamentals, giving you a great sense of the potential to grow your savings, but also the ups and downs you can expect over shorter periods.

2. The actual results of many savers and investors into the stock market – in particular it shows how not to do this. (This is chapter 10 from my book Clueless)

Give yourself a little time to read these two linked blogs. Do feel free to get back to us with your thoughts or questions on these.

A Great Idea: Monthly Investing

Investing monthly is a great idea in itself. You have a direct debit from your bank account, which provides the discipline, so that you don’t have to take any action each month. But invest into what?

When you are investing monthly you invest into funds of one kind or another.

For example, stock market funds are a great way to invest into the stock market. They spread your money across shares of many individual companies, typically 50-100.

This spread (or diversification) means that you can’t lose all of your money – which you most certainly can if you buy shares of only one company.

Investing in funds is a great idea. From their humble beginnings, investment funds have given all of us the opportunity to participate in the dynamism and profitability of not just our own economy, but exciting opportunities around the globe.

Funds present you with a powerful but still straightforward solution.

Uncovering Winning Funds:

We’ve already covered:

- why you should start investing now. The power of compounding your growth from year to year, shown in the graph and table earlier.

- what you should invest into – funds, simple but highly effective.

Now the big question is how to uncover the winning funds, the one’s which will supercharge the growth rates you saw on that earlier graph.

The world’s most successful investors, the billionaires, have two elements to their success – process and discipline.

You now have the discipline, with a monthly direct debit – you cannot get more disciplined than that.

You now need a process which identifies funds with the greatest potential. Sadly, the fund rating services which we encountered since the 1980s were lacking, to say the least. So we set about building our own rating system, based on 10 years of intensive research and tyre-kicking from the mid Noughties.

If we were going to come up with a successful method for rating funds, it MUST have these criteria:

- Straightforward to identify top-rated funds.

- The underlying process must be clear and understandable.

- It must be repeatable.

- There must be long term evidence that it generates extra growth.

We back-tested various methods for selecting funds back to 1994. The method which stood head and shoulders above alternatives was what we now call Dynamic Fund Ratings.

Dynamic Fund Ratings met all of our criteria for an effective rating system:

- The funds to buy are given 5 stars. Couldn’t be more straightforward.

- The 5-star funds are the top 20% of funds over the prior 6 months. That’s clear.

- It is easy to repeat this process every 6 months.

- The evidence for achieving extra performance is superb.

Next week we’ll focus on that final bullet point plus the most important bit – how to get going, and which are the winning funds right now. You will be amazed at the evidence of success, and what this can achieve for your life plans.