How is your investment portfolio like a garden? Never thought about it in those terms? Sometimes a different perspective helps to see the wood for the trees...

As the Chelsea Flower Show starts on Monday, we thought we’d bring the two (seemingly polar opposite) topics in tandem with one another.

A beautiful but low maintenance garden might require little more than pruning and tidying twice a year.

Many will judge you by looking at your garden. What you might see as “interesting and wild”, others will see as a mess which needs a lot of money spent on it.

Similarly, your investments. You might smile and call it eclectic – but the reality is that it has no structure and is hugely underperforming.

A portfolio can also be low maintenance but high performance.

We have illustrated many times that a simple process applied twice yearly for 30 minutes can hugely improve performance.

You may opt to keep your

portfolio garden maintenance as easy as possible, perhaps you are strapped for time and simplicity is key. For your investments, this may come in the form of our

Dynamic UK All Companies Portfolio.

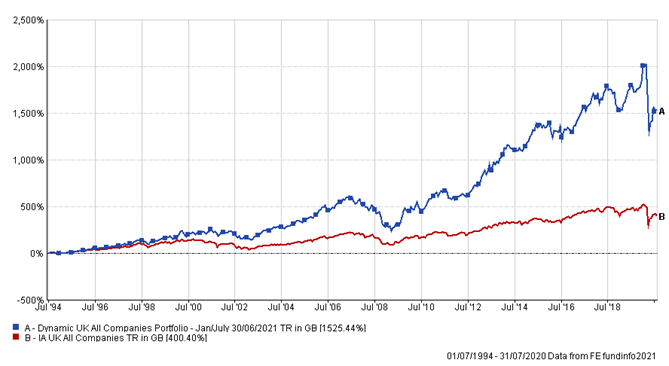

For example, using momentum to select winning funds every 6 months has boosted the performance of the UK All Companies portfolio by more than 5.7% per annum from 2008 to 2020, compared to the index in the table below. That’s life changing.

|

Annualised Return Since 2008:

|

|

FTSE 100

|

5.04%

|

|

Dynamic UK All Companies Portfolio

|

10.80%

|

Chart 1: Dynamic UK All vs UK All Companies Sector Average - Since July 1994

Conversely, you may want to take a bit more risk with your funds flowers, by making a bold statement. This could be portrayed by following our Dynamic Bonkers 6-Month Portfolio. You’re never quite sure what might appear with this strategy, but making sure you maintain tight discipline, and applying a Stop-Loss cutting away any nasty weeds, quickly, is key.

Yet again, more than twice the return of the index since 2008, as you can see below.

|

Annualised Return Since 2008:

|

|

FTSE World

|

10.55%

|

|

Dynamic Bonkers 6-Month Portfolio

|

24.11%

|

Chart 2: Dynamic Bonkers 6-Month vs FTSE World - Since January 2008

The final approach may be slightly more eclectic. Perhaps "home bias" is a tad boring for you, and you prefer broadening your horizons. This could include some weird and wonderful

investments seeds from Asia and the emerging world. Here’s where our

Dynamic Asia & Emerging Markets Portfolio could add some panache to your current offering.

Again, more than twice the annual returns of the index.

|

Annualised Return Since 2008:

|

|

MSCI Asia-Pacific Index

|

8.36%

|

|

Dynamic Asia & EM Portfolio

|

17.80%

|

Chart 3: Dynamic Asia & EM Portfolio vs MSCI Asia Pacific Index - Since January 2008

Choosing a bad gardener probably won’t ruin your life. Selecting a poor adviser, or investing on a whim, can irretrievably destroy your wealth.

Last but not least a great garden and a consistently outperforming portfolio have one thing in common – a thoughtful plan, consistently applied.