What’s the problem for most investors? They have no means to consistently select outstanding funds. Here we review and update a robust and powerful solution: the unique Dynamic Fund Ratings, which is our take on momentum investing.

Here we look under the bonnet at index trackers, the UK All Companies fund sector, similarly UK Smaller Companies, plus the Global fund sector. As you will see, the performance remains consistently impressive. This is a MUST READ for those who want to fulfil their investing potential – not by taking daft risks, but by making hugely better fund choices.

We’re updating the research for our unique fund ratings system - Dynamic Fund Ratings – giving you a early preview of the results. As you will see, the historical performance is consistently impressive.

There are a number of ratings systems out there and there are numerous tipsters. But none – to our knowledge – provide evidence of how their process (if there is one at all) has the potential to consistently generate outstanding profits for you.

Our Dynamic Fund Ratings are based on a form of momentum investing. At its simplest – this means buying an investment (in this case a fund) which is already performing well in the likelihood that it will continue to perform well; a trend that we see throughout history.

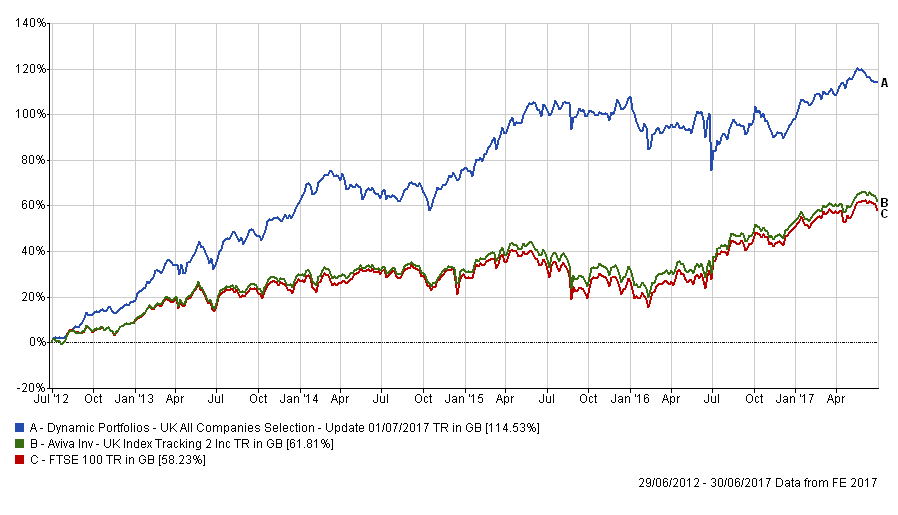

To give this some context, a manager of a simple FTSE 100 tracker fund would aim to return something similar to the index over 5 years. For the 5-year period ending 01/07/2017, the FTSE 100 index returned 58% and a fund tracking the index returned 62% (Aviva UK Index tracking fund).

In stark contrast, if you had used Dynamic Fund Selection to select funds in the UK All Companies sector you would have generated 115% - more than double the index tracker return.

See what this difference looks like in the chart below.

Here are the highlights from three sectors based on our updated results for 216 five year rolling periods since 1994.

UK All Companies using Dynamic Fund Ratings

- The most popular sector for investors.

- 7.83% extra growth per annum vs. the sector average...

- 92.59% likelihood that you would achieve better performance than the average fund in any 5-year period.

UK Smaller Companies using Dynamic Fund Ratings

- A sector with huge potential, typically providing somewhat better growth than from funds focused on larger companies.

- 10.80% extra growth per annum vs. the sector average...

- 91.20% likelihood that you would achieve better performance than the average fund in any 5 year period.

Global using Dynamic Fund Ratings

- A very broad sector with a rich mixture of equity opportunities, which is reflected in the funds you would have held.

- 8.28% extra growth per annum vs. the sector average...

- 89.91% likelihood that you would achieve better performance than the average fund in any 5-year period.

Summary

Our Dynamic Fund Ratings, unique to FundExpert.co.uk, offer investors a straightforward way to select outstanding funds. At a time when growth is hard to come by, an extra 7% or more, every year, is invaluable.

ACTION FOR INVESTORS

- Take a look at our full Dynamic Fund Research to see more detail on other sectors as we update them.

- Use our Rate My Funds tool to analyse your portfolio. It is quick and the results can be powerful!

- We have many more exciting updates coming shortly. Keep an eye on your inbox…

FURTHER READING

Chart 1: Dynamic Fund Selection vs. the FTSE 100 index and an index tracking fund