Below you will find an overview of how we built the portfolio and then the performance details for each individual portfolio including a performance chart, table and details of the most recent review.

Remember that the reviews we track here are carried out at set points during the year. If you wish to create this portfolio on a different cycle then you can do that using the tools on the site.

Portfolio Overview

This portfolio focusses on Asia and Emerging Markets.

Sectors: (UT) Asia Pacific Excluding Japan, (UT) China, (UT) Global Emerging Markets, (UT) India, (UT) Japan, (UT) Latin America and funds from the (UT) Specialist sector with a focus on Asia and Emerging Markets

Fund selection: Best three funds from these sectors

Review period: 6-monthly

Our review cycle: March/September

To re-create this portfolio on a different review cycle go to Best Funds by Sector > Unit Trusts only and then select each of the sectors mentioned above. You can then sort the results by 6-month performance and select the best performing funds from across these sectors.

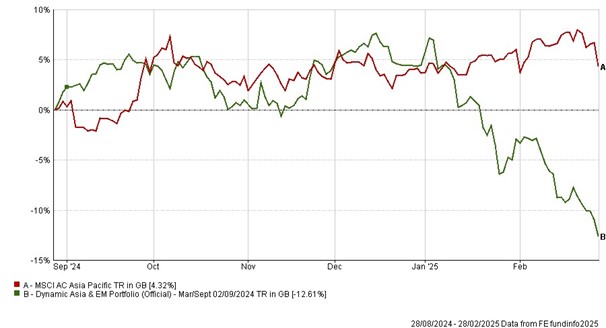

Performance Chart (Review Period)

Performance Table

| Name |

6m |

1yr |

3yr |

5yr |

| Dynamic Asia & EM Portfolio (Official) |

-12.61 |

-5.27 |

30.46 |

105.41 |

| MSCI AC Asia Pacific |

4.32 |

9.48 |

15.16 |

34.00 |

| Data as of: 03/03/2025 |

|

|

|

|

Latest Review

The latest funds from Mar 2025 are: