Below you will find an overview of how we built the portfolio and then the performance details for each individual portfolio including a performance chart, table and details of the most recent review.

Remember that the reviews we track here are carried out at set points during the year. If you wish to create this portfolio on a different cycle then you can do that using the tools on the site.

Portfolio Overview

This portfolio contains funds from a variety of low risk sectors.

As an aside, some might query emerging market bond funds in this selection. We classify them (at a push) as the top end of low risk. From the portfolio’s inception in July 1995 to July 2021, they accounted for only 9% of all fund selections.

Sectors:

1. (UT) Sterling Corporate Bond, (UT) Sterling High Yield, (UT) Sterling Strategic Bond, (UT) UK Gilts, (UT) UK Index Linked Gilts, (UT) Global EM Bonds - Blended, (UT) Global EM Bonds - Hard Currency, (UT) Global EM Bonds - Local Currency, (UT) EUR Corporate Bond, (UT) EUR High Yield Bond, (UT) EUR Mixed Bond, (UT) Global Corporate Bond, (UT) Global Government Bond, (UT) Global High Yield Bond, (UT) Global Inflation Linked Bond, (UT) Global Mixed Bond, (UT) Specialist Bond, (UT) USD Corporate Bond, (UT) USD High Yield Bond, (UT) USD Mixed Bond

2. (UT) Mixed Investment 0-35% Shares

3. (UT) UK Direct Property

Fund selection: Best three funds from bucket 1, best single fund from bucket 2, best single fund from bucket 3

Review period: 6-monthly

Our review cycle: January/July

Re-creating this portfolio on a different review cycle does require a bit more work compared to our other Dynamic Portfolios. You'll need to go to Best Funds by Sector > Unit Trusts only and select each of the sectors mentioned above. You can then sort the results by 6-month performance and select the best performing funds from across these sectors.

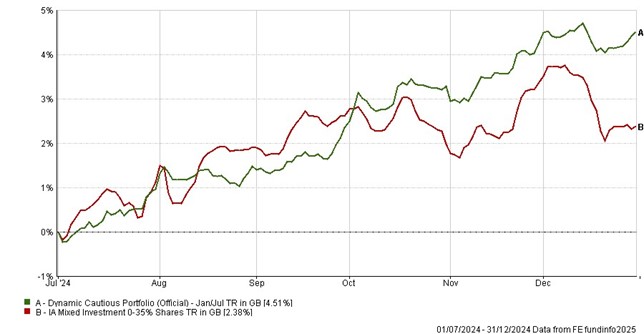

Performance Chart (Last 6 Months)

Performance Table

| Name |

6m (%) |

1yr (%) |

3yr (%) |

5yr (%) |

| Dynamic Cautious Portfolio - Jan/Jul |

4.51 |

8.71 |

-9.82 |

-3.75 |

| (UT) Mixed Investment 0-35% Shares Sector Average |

2.38 |

4.42 |

-1.37 |

5.38 |

| Data as of: 02/01/2025 |

|

|

|

|

Latest Review

The latest funds from Jan 2025 are: